Sales Tax and Reverse Sales Tax Calculator Nevada

(Tax Year 2026: Last Updated on January 30, 2026)

Nevada levies a 6.850% state-wide general sales tax, which can rise to 8.375% as Nevada's counties, cities, or municipalities charge local sales tax. Using this calculator, you can determine both the ordinary and reverse sales taxes in Nevada. The amount before taxes, the amount after taxes, and the tax rate are the only pieces of information needed to obtain the answers.

- 4.6%

- 6.85%

- 7.1%

- 7.6%

- 7.725%

- 7.73%

- 8.1%

- 8.25%

- 8.265%

- Amount Before Tax ${{amountBeforeTax}}

- Sales Tax Rate {{SalesTaxRate}}%

- Amount Of Taxes ${{AmountOfTaxes}}

- Amount After Taxes ${{AmountAfterTaxes}}

Nevada – NE Sales Tax Calculator: User Guide

Nevada is a state located in the United States' midwestern region, sharing its borders with Idaho to the northeast, Arizona to the southeast, Oregon to the northwest, California to the west, and Utah to the east.

Nicked named as the Silver State, Nevada is famous for its prettiest landscape, endless desert, nearly 300 days of sunshine, Area 51, gambling, and the bright lights of Las Vegas. Moreover, the state also has a flourishing economy with an impressive growth rate, favorable business environment, and plenty of business and employment opportunities. Consequently, attracting numerous people to settle in the state.

If you plan to relocate, expand, or start your business in Nevada, you should be aware of everything about NE Sales Tax. Can't find the information? Don't worry! You are at the right place.

Our experts have researched days and nights to bring a comprehensive NE Sales Tax guide and a handy Nevada Sales Tax Calculator to makes your decision process a lot easier. So let's dig in!

Nevada Sales Tax Facts:

- The general sales tax rate in Nevada levied on the state level is 6.850%. On top of it, many counties and cities collect local sales tax that ranges from 0.00% to 1.415%.

- Nevada may also charge a special sales tax ranging between 0% and 0.25% in some special cases.

- Some counties like Clark County levies a special sales tax rate, which goes up to 13% on accommodation businesses like hotels.

- The common types of Sales Tax charged in Nevada include rental tax, sellers use, lodgings tax, consumers use, general sales tax, and more.

- Winchester, Nevada is among the cities that levy the lowest possible combined sales tax of 4.6%.

- The Lakes, Nevada, is among the cities that levy the highest possible combined sales tax of 8.375%.

- 831% is the average combined sales tax levied in Nevada.

- Nevada State has a lower state sales tax than 75% of the states in the US.

- Newspapers, prescription drugs, prosthetic devices, and other types of durable medical equipment, as well as groceries, are exempted from Nevada sales tax.

- Nevada sales tax is only applied to end consumers of the product, so goods purchased by Individuals and companies for resale, improvement, or raw materials can be exempted from NE sales tax using Nevada Sales Tax Exemption Form.

- 85% of State Use Tax plus local use tax is applied to the items bought from online or out of state sellers and are not subjected to Nevada Sales Tax.

How to calculate Sales Tax in Nevada?

Businesses and Sellers involved in the sale, transfer, barter, licensing, lease, rental, use, or other consumption of most tangible personal property (with a few exceptions) and some services, and having Nexus in Nevada are required to register for Nevada Sales tax. They are required to collect, manage, and remit it to the Nevada Department of Taxation while staying in compliance with state laws and avoid penalties and interest.

The sales tax determined on four factors:

- Nexus: It is a connection of business with a state. The business is only liable to pay taxes to the states with Nexus.

- Out of State Seller's Eligibility: Out of State Sellers are only required to register, collect, and remit the sales tax to the state's authorities if it falls under the criteria provided by the state.

- Location and Products or Services: The sales tax rate varies from product to product and location to location. You must check the sales tax rate applicable to your product according to the product category, county, and city in Nevada.

- Exemptions: Almost all goods are eligible for sales tax regulation—however, Newspapers, prescription drugs, groceries, prosthetic devices, and other types of durable medical equipment along with some other products that are exempted under Nevada Law. So you should check with the Nevada state government as to which goods and services sold in Nevada are subject to sales tax.

To calculate Sales Tax in Nevada, follow the steps below:

Step 1 – Determine your Nexus:

As a business owner, you are only required to collect sales tax if you are eligible for collecting sales tax and have Sales Tax Nexus in the Nevada State. And to determine your Nexus in Nevada, you must have any of the following:

- Having a physical location in Nevada, such as office, or other business locations.

- An employee, independent contractors, or other sales representative working for you in Nevada.

- Having an inventory or ownership of goods in a warehouse, storage facility, etc. In NE.

- Delivery of merchandise in Nevada in vehicles.

- Ownership of personal or real property.

Step 2 – Determine the eligibility to collect sales tax as an out-of-state seller:

Out of State Seller is eligible to register, collect and remit sales tax under Nevada Law, if:

- Fulfilling any of the points as mentioned above, Or;

- Having an Economic Nexus where remote sellers make more than $100,000 in sales annually or more than 200 transactions in Nevada in the previous or current calendar year.

Step 3 – Determine the Sales Tax Rate:

Once you have determined that your Nexus is with Nevada, next is to deduce the Sales Tax rate (State + County + City) applicable to your product, for which you can refer the tables below:

| County | State Rate | County Rate | Total Sales Tax |

|---|---|---|---|

| Churchill | 6.850% | 0.750% | 7.600% |

| Clark | 6.850% | 1.400% | 8.250% |

| Douglas | 6.850% | 0.250% | 7.100% |

| Elko | 6.850% | 0.250% | 7.100% |

| Esmeralda | 6.850% | 0.000% | 6.850% |

| Eureka | 6.850% | 0.000% | 6.850% |

| Humboldt | 6.850% | 0.000% | 6.850% |

| Lander | 6.850% | 0.250% | 7.100% |

| Lincoln | 6.850% | 0.250% | 7.100% |

| Lyon | 6.850% | 0.250% | 7.100% |

| Mineral | 6.850% | 0.000% | 6.850% |

| Nye | 6.850% | 0.750% | 7.600% |

| Pershing | 6.850% | 0.250% | 7.100% |

| Storey | 6.850% | 0.750% | 7.600% |

| Washoe | 6.850% | 1.415% | 8.265% |

| White Pine | 6.850% | 0.875% | 7.725% |

| City | State Rate | County + City Rate | Total Sales Tax |

|---|---|---|---|

| Boulder City | 6.850% | 1.400% | 8.250% |

| Caliente | 6.850% | 0.250% | 7.100% |

| Carlin | 6.850% | 0.250% | 7.100% |

| Carson City | 6.850% | 0.750% | 7.600% |

| Elko | 6.850% | 0.250% | 7.100% |

| Ely | 6.850% | 0.875% | 7.725% |

| Fallon | 6.850% | 0.750% | 7.600% |

| Fernley | 6.850% | 0.250% | 7.100% |

| Henderson | 6.850% | 1.400% | 8.250% |

| Las Vegas | 6.850% | 1.400% | 8.250% |

| Lovelock | 6.850% | 0.250% | 7.100% |

| Mesquite | 6.850% | 1.400% | 8.250% |

| North Las Vegas | 6.850% | 1.400% | 8.250% |

| Reno | 6.850% | 1.415% | 8.265% |

| Sparks | 6.850% | 1.415% | 8.265% |

| Wells | 6.850% | 0.250% | 7.100% |

| West Wendover | 6.850% | 0.250% | 7.100% |

| Winnemucca | 6.850% | 0.000% | 6.850% |

| Yerington | 6.850% | 0.250% | 7.100% |

Step 4 – Calculate Sales Tax:

After determining the sales tax rate according to the location and type of purchases, it is easy to calculate the sales tax amount charged on the product and gross price (amount after tax) of a product.

Example # 1:

For instance, you sell a Laptop Charger on your store in Winnemucca, Nevada, having a net cost of $30. The amount of Sales Tax that you have to pay on the Laptop Charger would be:

Manual Method:

Net Price (amount before Tax) of a Laptop Charger: $30

Total Sales Tax rate: 2.00% (Winnemucca) + 0.00% (Humboldt County) + 6.850% (Nevada State) = 6.850%

Total Sales Tax amount = $30 x 6.850% = $2.1

Gross Price (Amount after Tax) = 30 + 2.1 = $32.1

The sales tax amount charged on the Laptop Charger would be $2.1, raising its gross cost to $32.1.

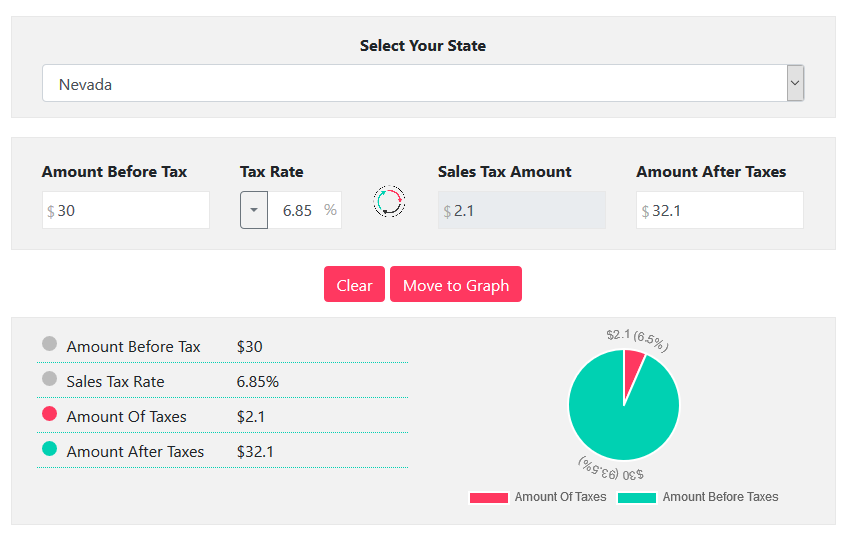

Using our Sales Tax Calculator:

All of the steps mentioned above can be skipped to get an instant result using our Sales Tax Calculator. All you need is:

- Input the $30 Net Price of a Laptop Charger as Amount Before Tax

- Input or select 850% of the combined Sales Tax rate on the Tax Rate menu.

Our calculator will automatically calculate the result, and represents it in 3 different forms, as shown in the image below:

Reverse Sales Tax Calculation

In the example above, we have explained to you to calculate the Sales Tax amount payable in a product, and the Gross Price of the Product.

But there are times when you are required to deduce how much Sales tax you have actually paid on a product in Nevada.

This is where the Reverse Sales Tax Calculation Kicks in. And luckily, our Nevada Sales Tax Calculator can perform this calculation like a Pro.

Example:

The gross cost (amount after tax) of a Laptop Bag is $75, which you sell on your store in Norfolk, Nevada. If you want to deduce the amount of sales tax you have actually paid on it and the net cost (amount before tax) of a Laptop Bag, you can follow the following steps:

Gross Price (Amount after Tax) of Laptop Bag: $75

Total Sales Tax rate: 1.50% (Amargosa Valley) + 0.750% (Nye County) + 6.850% (Nevada State) = 7.60%

Manual Method:

Gross Price with sales tax = [Net Price × (tax rate in decimal form + 1)]

75 = [Net Price x ((7.6/100) + 1)]

75 = Net Price x 1.08

$69.4 = Net Price

So the original Price (net price) of the Laptop Bag would be $69.4.

Using our Sales Tax Calculator:

You can also use our Sales Tax Calculator for Reverse Sales Tax calculation to skip the aforementioned manual method. All you need is:

- Input the $75 Gross Price of Laptop Bag as Amount after Tax

- Input or select 7.60% of combined Sales Tax Rate on the Tax Rate

Our calculator will automatically calculate the result and represents it in 3 different forms.

FAQs

Answer: The general sales tax rate in Nevada levied on the state level is 6.850%. On top of it, many counties and cities collect local sales tax that ranges from 0.00% to 1.415%.

Answer: The combined sales tax levied in Las Vagas, Nevada, is 8.250%, which comprises 1.40% of local sales tax and 6.850% of Nevada State Sales Tax.

Answer: Newspapers, prescription drugs, groceries, prosthetic devices, and other types of durable medical equipment along with some other products that are exempted under Nevada Law.

Answer: No, Groceries are not taxed in Nevada, unless prepared for immediate consumption such as in a restaurant.

Answer: The combined sales tax levied in Henderson, Nevada, is 8.250%, which comprises of 1.40% of local sales tax and 6.850% of Nevada State Sales Tax.