Biweekly TimeCard Calculator: Biweekly Timesheet

This Biweekly Timesheet Calculator allows you to total your time at work for two weeks. You can also calculate the total amount you will get for the hours you spend by entering the per-hour rate. The easy check-in and check-out entering in AM and PM also calculates the total time spent in a day and a week and then totals it down to two weeks.

- Choose Week 1 by clicking Empty Box of Week1.

- You can Enter the timings from Monday to Sunday.

- Use IN Box to Enter the time of work starting.

- Use OUT Box to Enter time of leaving.

- Use Dropdown Button for selecting AM/PM

- Choose week 2 by clicking empty Box of Week2.

- You will get Total Time of each week in week1 and week2 in boxes against red buttons at the end.

- See the Grand Total Box for both week results.

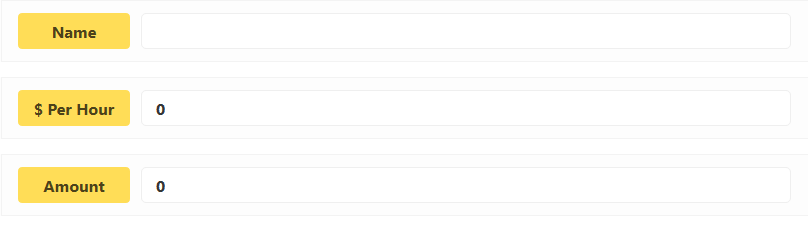

- Enter Employe Name In Name Box(Yellow button).

- Enter Hourly Rate$ in box against $ per Hour Button.

- You will get Total Amount to be paid in Amount Box

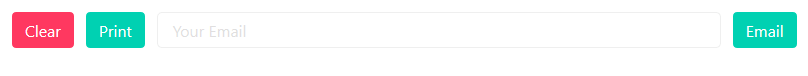

- Use Clear Button to Clean the entire sheet written.

- Use Print Button To Print the complete TimeCard.

- Use Email Box if you want to recieve the complete TimeCard at your Email ID.

| Days | Check In | Check Out | Total Time |

|---|---|---|---|

| {{timeSlot.day}} |

Check In

:

|

Check Out

|

| Days | Check In | Check Out | Total Time |

|---|---|---|---|

| {{timeSlot1.day}} |

Check In

:

|

Check Out

|

Week 1

Week 2

Total

Name

$ Per Hour

Amount

Clear

How to Use Biweekly Timecard Calculator?

Bi-Weekly timecards are used to record work time for the employees who are paid once in two weeks. Later, the record is used to process the 2-weeks Salary of each employee according to their total hours worked.

This process can be tricky and risky if done manually, which may increase the chance of human error. Therefore, we have introduced our simple, instant, and accurate Bi-Weekly Calculator to minimize your process as far as possible.

Here is the step by step guide on how to use Our Bi-weekly Calculator to calculate total hours worked in a day, a week, in 2 weeks and finally the amount payable according to the hourly rate:

Step 1:

Upon initiating the Bi-Weekly Calculator, you will see a table with several columns and rows having their respective labels. For better understanding, we will divide the Table into FOUR sections where:

- Section 1 is for entering Check IN and Check OUT time for Week 1 to calculate Total Hours Worked in Week 1.

- Section 2 is for entering Check IN and Check OUT for Week 2 to calculate Total Hours Worked in Week 2.

- Section 3 is to display Total Hours Worked in Week 1, Total Hours Worked in Week 2, and Total Hours Worked in Bi-Week (2 Weeks).

- Section 4 is to calculate Bi-Weekly salary using your Hourly Rate and Total Hours Worked in Bi-Week (2 Weeks).

Start the process by clicking on the textbox next to "Choose Week 1" Label in Section 1 (As shown in the picture above"). This will launch a calendar on which you can select your desired 1st week’s START date.

Step 2:

Just below the "Choose Week 1" bar, you will see a table with several rows and textboxes. Each row represents each day in a week.

- Now start entering the Hours and Minutes for starting time of work in "Check IN" Field, where 1st textbox is for Hours, and 2nd textbox is for the Minutes.

- After entering the Hours and Minutes, choose between AM and PM by clicking on the dropdown menu displaying AM as a default value.

- Repeat the same as stated above in Check OUT Field, for End Time of Work.

- After you have entered your Start Time and End Time of work, respectively, in Check IN and Check OUT fields, you would see Total Hours Worked in a Day in the last column (as shown in the image above).

Now repeat the step a, b, and c of Step 2 to fill out all the seven rows, to input and calculate Total Hours worked in Week 1.

Step 3:

As this is the Bi-Weekly Calculator, you have an option to calculate Total Hours Worked in 2 Weeks. Therefore, you will see Section 2, which is for Week 2, bearing the label "Choose Week 2".

Repeat Step 1 and Step 2 to calculate Total Hours Worked in Week 2.

Step 4:

After you have entered all the values, the resulting Total Hours Worked in Week 1 and Week 2 will appear in their respective fields in Section 3, along with their sum as Total Hours Worked in Bi-Week (2 weeks) in Total Field. (As shown in the picture above).

Step 5:

In Section 4, you have a facility to enter the Name of your Employee in Name Field and their Hourly Rate in "$ per Hour" Field.

After you have entered the Hourly Rate, our Bi-Weekly Calculator will instantly calculate the Payable Amount for 2 Weeks for the employee.

The last field (As shown in the picture above) can be used for the following purpose:

- You can reset the calculator by clicking on the red "Clear" Button.

- You can Print the entire sheet by clicking on the "Print" button.

- You can also email the entire sheet to anyone by entering their Email Address and pressing the Email button.

FAQs

Solution: There are several methods to o calculate Bi-weekly hours worked manually from which we are going to tell you the best and effective one.

Here are the steps you need to follow to calculate biweekly hours worked with Paid Lunch Breaks:

- Use a Piece of Paper, Ms. Excel, any other Spreadsheet Application or Timecard to record Start Time (Time IN) and End Time (Time Out) for each day of work in Bi-Week (2 Weeks).

- If your Lunch Breaks are unpaid, then you should not consider it in Total Hour Worked. Instead, you are suggested to divide your work time into two shifts, having lunch break gap in-between. In a Result, you will have 2 Start Times and 2 End Times of work in a day.

- Make sure all recorded times are in Military Time (24-Hours Format) as it makes it easy to add or subtract time.

- You can also use our Military Time Converter to convert your AM/PM time into Military Time instantly.

- Now subtract all Start Times (Time INs) from their respective End Times (Time OUTs) to deduce Total Hours and Minutes Worked in a Day.

- Subtracting two times is not as simple as subtracting two numerical values. Therefore, you are suggested to use our Time Duration Calculator to calculate the duration instantly with accuracy.

- Add all the values of Total Hours and Minutes Worked in a Day to get Total Biweekly Hours and Minutes Worked.

- Adding multiple time values is not as simple as adding multiple numerical values. For that reason, you are suggested to use our Hour Calculator for an accurate sum of time.

- Finally, you need to convert your Total Biweekly Hours and Minutes Worked into Total Hours Worked in a Bi-Week (2 Weeks) by using our Decimal to Hours Calculator or the following Decimal Hours Conversion Method.

Decimal Hours Conversion Method:

The following example will explain this method in the best way:

Example:

- Biweekly Hours and Minutes Worked by John is 50 Hours and 30 Minutes.

- the Minutes by 60: 30/60 = 0.5 Decimal Hours

- Decimal Hours into Original Hours: 50+0.5 = 50.5 Hours.

- Hours Worked in a Bi-Week (2 Weeks) = 50.5 Hours.

These were the steps you need to follow. If you find them time-consuming and tricky, you can always use our FREE Bi-Weekly Calculator to skip almost all the steps as mentioned above.

Solution: There are numerous manual methods and automated calculators to calculate Salary every two weeks. However, not all of them are accurate except for our Two Weeks Calculator that is built and tested by experts to give you instant and reliable results.

If you are looking for manual method, follow the steps below:

- To calculate your Salary every two weeks, you need to have Total Hours Worked in 2 Weeks. Wherefore, you are suggested to follow the steps mentioned in FAQs Question # 1.

- Once you have calculated your Bi-weekly Hours Worked, multiply them with your Hourly Rate to calculate your Gross Salary for Two Weeks.

- As you are subjected to Withholding Taxes and other Deductions, you should deduct them accordingly from your Salary. Then add bonuses and overtime, double-time, etc. in the Salary to deduce your Net Payable Salary. If you don’t know how to add and subtract these bonuses and charges, you can use our Paycheck Calculator for this purpose.

Solution: to calculate the duration of your lunch break, follow these steps:

- Record Start Time of your Lunch Break.

- Record End Time of your Lunch Break.

- Now Subtract the Start Time from End Time to calculate the Duration of your Lunch Break.

If you want to calculate lunch break duration from your Time Card that records your work time in 2 shifts, ignoring only your lunchtime, then follow these steps:

- In this case, your End Time of Work in First Shift will be the Start Time of your lunch break, and the Start Time of your work in Second Shift will be the End Time of your Lunch Break.

- Now Subtract the Start Time from End Time of your Lunch Break to calculate the Duration of your Lunch Break.

Solution: Total Hours worked (Regular Hours) may not be the same as Payroll Hours, as it includes Total Hours Worked (Regular Hours) plus paid vacations, personal, paid sick time, double time, overtime, etc..

Here are the steps along with an example to calculate Payroll Hours for a Week with Paid Lunch Breaks:

- First, you need to calculate Total Regular Worked Hours in a weekby following the method stated below:

- Record Time INs and Time OUTsof work for a week on a piece of paper or a spreadsheet, or you can also use the Data from Timecard.

- Convert all your times into 24-Hours Format.

- Subtract all Times INsfrom their respective Time OUTs to get Total Regular Hours and Minutes worked in a Day.

- Now Add together all Total Regular Hours and Minutes worked in a Dayto get Total Regular Hours and Minutes Worked in a Week.

- Convert your Total Regular Hours and Minutes Worked in a Weekinto Total Regular Hours worked in a Week by dividing Minutes by 60 and add the result to original hours.

- Now, for example, if your employee has 30 Regular hours Worked, 24 vacation Hours, 5 Sick Hours, and 3 personals in a week, then his payroll hourswould be: 30+24+5+3 = 89 Payroll Hours.

Note: Every Employer and government have their own rules of Payroll. Some employers pay sick leaves, lunch breaks, etc. but some don’t. Therefore, you need to read your company’s policy or contract of employment to calculate your exact payroll hours.

Although it depends upon your total hours' work in bi-week to calculate your Pay according to your hourly rate of 17$. However, if, for instance, your Total Hours Worked Bi-weekly is 50 Hours, then your gross Pay with $17 an hour would be: 50 x 17 = $850.

Suggestion: Do you want to calculate the exact gross Pay with your $17 hourly rate? Then you are suggested to input all your Start Time and End Time of work for each day in Bi-Week on our Bi-Weekly calculator, to deduce your total hours work in bi-week. Finally, add your hourly rate at the bottom of the calculator to calculate your Gross Pay automatically, instantly, and accurately.

Note: This result is just your Gross Pay according to your Regular Worked Hours. You have to deduct your withholding taxes and include your bonuses and overtimes etc. to calculate the Net Pay. You can also use our Paycheck Calculator to get this work done neatly and nicely.

A full-time salaried employee is paid for 80 hours in a bi-weekly pay period, but the total hours worked may vary from person to person working on Hourly bases.

Every country and even every employer have their own employment "laws" that both employee and employer need to follow. However, laws set by the employer should never go against the state’s constitution.

Talking about the United States of America, an average employee is expected to work for 8 hours a day (9 AM to 5 AM) with lunch being unpaid. They can eat during work, but they can’t take a lunch break. Nevertheless, if your employer agrees upon paying for your lunch break during an 8-hour job, then you are lucky.

Every country, state, and even employer have their own "laws" on which every employer and employee are bound to follow. However, an employer can never go against the laws of a state or country. Therefore, it is suggested to refer to your Contract of Employment or discuss it with your employer to know everything about your paid working hours and whether you have an option for paid lunch breaks or not.

Here are some facts that may help:

- According to the survey, about 50% of the employees prefer to have lunch while instead of taking a lunch break.

- According to The Fair Labor Standards Act (FLSA), Employers are not bound to provide lunch or lunch breaks to their employees. However, if they offer it, then it should be paid.

Both paying methods have their Pros and Cons. Below are some of them:

- From the perspective of employees, the bi-weekly payment method is better. It is because employees are paid 26 times a year, in contrast with semi-weekly where employees are paid 24 times; hence, they are paid more in bi-weekly.

- From the perspective of the employer, the Semi-Weekly method is efficient because they have to prepare and pay two fewer payrolls to their employees every year.

- From the perspective of the organization, the bi-weekly method is easy to implement as payrolls are prepared every two weeks on the same day, in contrast with semi-weekly, where payroll day keeps on shifting.

- Bi-weekly methods make it easy for employees to budget their income due to their fixed payment day.

- Employers having employees on Salary prefer a semi-weekly approach, whereas employers with employees on hourly rates prefer Bi-weekly approach as it is easy to process, pay, and budget accordingly.

- During a Leap year, Employers are paid 27 times in a Year using the bi-weekly approach, whereas, employees would be paid only 24 times by Semi-monthly method.

There are 52 Weeks in a Year. Therefore, you will be paid 26 times a year through Bi-Weekly Method, whereas, there are 12 months in a year, so you would be paid 24 times a year by using Bi-Monthly Method.

The easiest, accurate, and quick method to calculate bi-weekly Pay is by using our Bi-Weekly Timesheet Calculator, located at the top of this page. All you have to do is to follow these steps:

- Choose your First Day of First Week from the calendar by clicking on the textbox in the "Choose week 1" field.

- Now enter Start Time and End Time of your Work in AM/PM format for each day in a Week.

- Repeat Step 1 and Step 2 for the Second Week to calculate Total Hours and Minutes Worked in Bi-Week. Bifurcated results will be displayed at the bottom of the calculator.

- Now Enter your Hourly rate in "$ Per Hour" Field to calculate your Gross Pay for Bi-Week.

- Finally, you can use our Paycheck calculator, to add and subtract Bonuses, overtimes, double-time, withholding taxes, and allowances accordingly to calculate your Bi-Weekly Net Pay.

Note:

- Biweekly-Pay Calculation process using our calculator is explained in more detail under "How to Use Bi-Weekly Calculator Section" just above the FAQs section.

- If you are looking for a manual method to calculate Bi-Weekly Pay, you are suggested to read Solution to FAQs Question # 2, above.