Sales Tax and Reverse Sales Tax Calculator West Virginia

(Tax Year 2026: Last Updated on January 30, 2026)

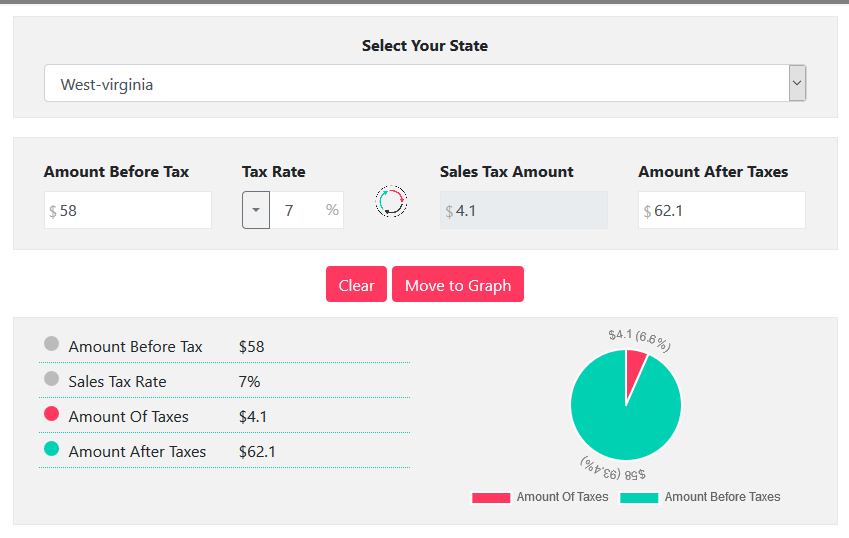

West Virginia's general sales tax rate is 6%. West Virginia cities and/or municipalities are empowered to acquire their own rate of up to 1% in local sales tax. This calculator computes West Virginia's standard and reverses sales taxes. Manually enter the amount before and after taxes, as well as the tax rate, to receive fast results.

- 6%

- 7%

- Amount Before Tax ${{amountBeforeTax}}

- Sales Tax Rate {{SalesTaxRate}}%

- Amount Of Taxes ${{AmountOfTaxes}}

- Amount After Taxes ${{AmountAfterTaxes}}

West Virginia – WV Sales Tax Calculator: User Guide

West Virginia, formerly dubbed the "Switzerland of America," is a state located in the Appalachian region (also considered part of the Mid-Atlantic Southeast Region) of the Southern United States of America.

This 41st-largest state (by area) and 38th most population state shares its borders with Ohio to the northwest, Pennsylvania to the northeast, Virginia to the southeast, Maryland to the east and northeast, and Kentucky to the southwest.

Charleston is the state's capital and the largest city, while Huntington-Ashland Tri-State Area is considered the largest metropolitan.

This "Switzerland of America" state is famous for its beautiful nature, lack of crowds, Cheap Housing, and unbelievably low living cost.

Although the economy and business environment in WV are not as favorable as in other states, many people, businesses, and entrepreneurs settle in this state to start a new life and earn a fortune.

So, if you are mulling over to start, expand, or relocate your business in West Virginia, then you should learn to deal with WV sales tax.

Our experts have created a comprehensive sales tax guide along with a handy West Virginia Sales Tax Calculator to educate and support you with all the WV sales tax essentials.

So let's start!

West Virginia Sales Tax Facts:

- 6% of the sales tax is levied on the state level in West Virginia. On top of the statewide sales tax, many cities also charge local sales tax ranging from 0.5% to 1%. Fortunately, no county or municipality levy any local sales tax.

- Cross Lanes, West Virginia, is among cities that levy the lowest possible combined sales tax rate of 6%.

- Athens, West Virginia, is among cities that levy the highest possible combined sales tax rate of 7%.

- 3% of states in the US have a higher sales tax rate than West Virginia.

- Newspapers, groceries, motor vehicles, Prescription drugs, and textbooks are among the taxable tangibles products which are exempted from West Virginia Sales Tax. Moreover, services, including personal services (massages, hairstyling, etc.), child care services, professional services (doctors, architects, lawyers, etc.), and fitness clubs, are also exempted.

- Goods and services that are used in West Virginia on which applicable sales tax has not been paid are subjected to WV Use tax of the equivalent rate as the West Virginia Sales Tax.

- Purchases for resale, improvement, or as raw materials by retailers can be made tax-free using West Virginia Sales Tax Exemption Form.

How to calculate Sales Tax in West Virginia?

Businesses and Sellers involved in most retail sales and some services unless exempted and have Nexus in West Virginia are required to register for West Virginia Sales tax and obtain a sales tax license.

They must collect, manage, and remit it to the West Virginia State Tax Department while staying in compliance with state laws and avoid penalties and interest.

The sales tax determined on four factors:

- Nexus: It is a connection of business with a state. The business is only liable to pay taxes to the states with Nexus.

- Out of State Seller's Eligibility: Out of State Seller is only required to register, collect, and remit the sales tax to the authorities in the state if it falls under the criteria provided by the state.

- Location and Products or Services: The sales tax rate varies from product to product and location to location, so you must check the sales tax rate applicable to your product according to the product category, county, and city in West Virginia.

- Exemptions: Almost all goods and some services are eligible for sales tax regulation—however, Newspapers, groceries, motor vehicles, Prescription drugs, and textbooks are among the taxable tangibles products which are exempted from West Virginia Sales Tax. Moreover, services, including personal services (massages, hairstyling, etc.), child care services, professional services (doctors, architects, lawyers, etc.), and fitness clubs, are also exempted.

- You should also check with the West Virginia Department of Revenue regularly about which goods and services sold in West Virginia are subject to sales tax.

To calculate Sales Tax in West Virginia, follow the steps below:

Step 1 – Determine your Nexus:

As a business owner, you are only required to collect sales tax if you are eligible for collecting sales tax and have Sales Tax Nexus in West Virginia State. And to determine your Nexus in West Virginia, you must have any of the following:

Economic Nexus in West Virginia State, where vendors who:- make more than $100,000 in sales annually in West Virginia in the previous or current calendar year;

- Or, make more than 200 transactions in the VW state during the last or current calendar year.

Step 2 – Determine the Sales Tax Rate:

Once you have determined that your Nexus is with West Virginia, next is to deduce the Sales Tax rate (State + City) applicable to your product, for which you can refer to the tables below:

| City | State Rate | County + City Rate | Total Sales Tax |

|---|---|---|---|

| Athens | 6.00% | 1.00% | 7.00% |

| Beckley | 6.00% | 1.00% | 7.00% |

| Bluefield | 6.00% | 1.00% | 7.00% |

| Bolivar | 6.00% | 1.00% | 7.00% |

| Bridgeport | 6.00% | 1.00% | 7.00% |

| CharlesTown | 6.00% | 1.00% | 7.00% |

| Charleston | 6.00% | 1.00% | 7.00% |

| Clarksburg | 6.00% | 1.00% | 7.00% |

| Davis | 6.00% | 1.00% | 7.00% |

| Dunbar | 6.00% | 1.00% | 7.00% |

| Elizabeth | 6.00% | 1.00% | 7.00% |

| Elkins | 6.00% | 1.00% | 7.00% |

| Fairmont | 6.00% | 1.00% | 7.00% |

| Follansbee | 6.00% | 1.00% | 7.00% |

| Grafton | 6.00% | 1.00% | 7.00% |

| HarpersFerry | 6.00% | 1.00% | 7.00% |

| Harrisville | 6.00% | 1.00% | 7.00% |

| Huntington | 6.00% | 1.00% | 7.00% |

| Kingwood | 6.00% | 1.00% | 7.00% |

| Martinsburg | 6.00% | 1.00% | 7.00% |

| Milton | 6.00% | 1.00% | 7.00% |

| Moorefield | 6.00% | 0.50% | 6.50% |

| Moundsville | 6.00% | 1.00% | 7.00% |

| NewCumberland | 6.00% | 1.00% | 7.00% |

| Nitro | 6.00% | 1.00% | 7.00% |

| Parkersburg | 6.00% | 1.00% | 7.00% |

| Pennsboro | 6.00% | 1.00% | 7.00% |

| Princeton | 6.00% | 1.00% | 7.00% |

| Quinwood | 6.00% | 1.00% | 7.00% |

| Ranson | 6.00% | 1.00% | 7.00% |

| Romney | 6.00% | 1.00% | 7.00% |

| Rupert | 6.00% | 1.00% | 7.00% |

| SaintAlbans | 6.00% | 1.00% | 7.00% |

| Shepherdstown | 6.00% | 1.00% | 7.00% |

| Sistersville | 6.00% | 1.00% | 7.00% |

| SouthCharleston | 6.00% | 1.00% | 7.00% |

| Thomas | 6.00% | 1.00% | 7.00% |

| Vienna | 6.00% | 1.00% | 7.00% |

| Wayne | 6.00% | 1.00% | 7.00% |

| Weirton | 6.00% | 1.00% | 7.00% |

| Weston | 6.00% | 1.00% | 7.00% |

| Wheeling | 6.00% | 1.00% | 7.00% |

| WhiteHall | 6.00% | 1.00% | 7.00% |

| Williamstown | 6.00% | 1.00% | 7.00% |

Step 4 – Calculate Sales Tax:

After determining the sales tax rate according to the location and type of purchases, it is easy to calculate the sales tax amount charged on the product and gross price (amount after tax) of a product.

Example # 1:

For instance, you sell a Leather Wallet in your store in Charleston, West Virginia, having a net cost of $28. The amount of Sales Tax that you have to pay on the Leather Wallet would be:

Manual Method:

Net Price (amount before Tax) of a Leather Wallet: $58

Total Sales Tax rate: 1.00% (Charleston) + 0.00% (Kanawha County) + 6.00% (West Virginia State) = 7.00%

Total Sales Tax amount = $58 x 7.00% = $4.1

Gross Price (Amount after Tax) = 58 + 4 = $62.1

So, the Sales Tax amount charged on the Leather Wallet would be $4.1, raising the gross cost to $62.1.

Using our Sales Tax Calculator:

All of the steps mentioned above can be skipped to get an instant result using our Sales Tax Calculator. All you need is:

- Input the $58 as the Net Price of a Leather Wallet as Amount Before Tax

- Input or select 00% of the combined Sales Tax rate on the Tax Rate menu.

Our calculator will automatically calculate the result and represents it in 3 different forms, as shown in the image below:

Reverse Sales Tax Calculation

In the example above, we have explained to you to calculate the Sales Tax amount payable in a product and the Gross Price of the Product.

But there are also instances when you are required to deduce how much Sales tax you have actually paid on a product in West Virginia.

This is where the Reverse Sales Tax Calculation Kicks in. And luckily, our West Virginia Sales Tax Calculator can perform this calculation like a Pro.

Example:

The gross cost (amount after tax) of a Handbag is $100, which you sell in your store in Moorefield, West Virginia. Now, if you want to deduce the amount of sales tax you have actually paid on it and the net cost (amount before tax) of a Handbag, you can follow the steps below:

Gross Price (Amount after Tax) of Handbag: $100

Total Sales Tax rate: 0.50% (Moorefield) + 0.00% (Hardy County) + 6.00% (West Virginia State) = 6.50%

Manual Method:

Gross Price with sales tax = [Net Price × (tax rate in decimal form + 1)]

100 = [Net Price x ((6.5/100) + 1)]

100 = Net Price x 1.07

$93.5 = Net Price

So, the original Price (net price) of the Handbag would be $93.5.

Using our Sales Tax Calculator:

You can also use our Sales Tax Calculator for Reverse Sales Tax calculation to skip the aforementioned manual method. All you need is:

- Input the $100 Gross Price of Handbag as Amount after Tax

- Input or select 6.50% of combined Sales Tax Rate on the Tax Rate

Our calculator will automatically calculate the result and represents it in 3 different forms.

FAQs

Answer: Almost all taxable tangible properties except Newspapers, groceries, motor vehicles, Prescription drugs, and textbooks are subjected to sales tax in West Virginia. Moreover, some services are also taxable except personal services (massages, hairstyling, etc.), child care services, professional services (doctors, architects, lawyers, etc.), and fitness clubs.

Answer: 6% of sales tax is charged on cars in West Virginia.

Answer: 6% of sales tax is charged on prepared food. However, groceries are exempted from sales tax in West Virginia.

Answer: Yes, Clothing items are fully taxed (6% plus local sales tax) in West Virginia.

Answer: 7% of the combined sales tax rate is charged in Morgantown, West Virginia. It comprises 6% of West Virginia State Sales Tax and 1% of Morgantown City Sales Tax.