Sales Tax and Reverse Sales Tax Calculator US

(Tax Year 2025: Last Updated on December 25, 2025)

This USA Sales Tax Calculator resolves numerous issues relating to the tax levied on the sales of goods and services. When used as a reverse sales tax calculator, it may determine the gross price using the net price and tax rate as inputs.

- 1%

- 2%

- 3%

- 4%

- 5%

- 6%

- 7%

- 8%

- 9%

- 10%

- 4%

- 5%

- 5.5%

- 6%

- 6.5%

- 7%

- 7.5%

- 7.625%

- 7.75%

- 8%

- 8.5%

- 8.75%

- 9%

- 9.5%

- 10%

- 10.5%

- 11%

- 0%

- 1%

- 2%

- 2.5%

- 3%

- 3.5%

- 4%

- 5%

- 6%

- 6.5%

- 7%

- 7.5%

- 7.85%

- 5.6%

- 5.85%

- 6.1%

- 6.3%

- 6.35%

- 6.6%

- 6.712%

- 6.9%

- 7.2%

- 7.6%

- 7.8%

- 7.85%

- 8.05%

- 8.1%

- 8.3%

- 8.35%

- 8.412%

- 8.5%

- 8.55%

- 8.6%

- 8.7%

- 8.8%

- 8.85%

- 8.9%

- 8.951%

- 9.1%

- 9.18%

- 9.181%

- 9.2%

- 9.212%

- 9.3%

- 9.35%

- 9.6%

- 9.8%

- 9.85%

- 9.9%

- 10%

- 10.1%

- 10.2%

- 10.35%

- 10.4%

- 10.6%

- 10.712%

- 11.2%

- 10.9%

- 6.5%

- 6.875%

- 7%

- 7.5%

- 7.75%

- 8%

- 8.125%

- 8.25%

- 8.375%

- 8.5%

- 8.625%

- 8.75%

- 9%

- 9.125%

- 9.25%

- 9.375%

- 9.5%

- 9.625%

- 9.75%

- 9.875%

- 10%

- 10.25%

- 10.375%

- 10.5%

- 10.75%

- 11%

- 11.25%

- 11.5%

- 6%

- 6.5%

- 7.25%

- 7.375%

- 7.5%

- 7.75%

- 7.875%

- 7.975%

- 8%

- 8.125%

- 8.25%

- 8.375%

- 8.475%

- 8.5%

- 8.725%

- 8.75%

- 8.875%

- 8.975%

- 9%

- 9.125%

- 9.25%

- 9.5%

- 9.75%

- 10%

- 10.25%

- 10.5%

- 2.9%

- 3.25%

- 3.3%

- 3.7%

- 3.75%

- 3.9%

- 4%

- 4.15%

- 4.2%

- 4.4%

- 4.5%

- 4.55%

- 4.65%

- 4.75%

- 4.9%

- 4.985%

- 5%

- 5.13%

- 5.27%

- 5.4%

- 5.45%

- 5.5%

- 5.65%

- 5.9%

- 5.985%

- 6.375%

- 6.4%

- 6.5%

- 6.7%

- 6.75%

- 6.813%

- 6.85%

- 6.9%

- 7%

- 7.01%

- 7.13%

- 7.25%

- 7.27%

- 7.35%

- 7.4%

- 7.5%

- 7.55%

- 7.6%

- 7.65%

- 7.75%

- 7.88%

- 7.9%

- 7.95%

- 7.96%

- 8%

- 8.02%

- 8.13%

- 8.15%

- 8.2%

- 8.25%

- 8.27%

- 8.31%

- 8.35%

- 8.375%

- 8.4%

- 8.485%

- 8.49%

- 8.5%

- 8.515%

- 8.6%

- 8.635%

- 8.65%

- 8.7%

- 8.73%

- 8.75%

- 8.845%

- 8.875%

- 8.9%

- 9.05%

- 9.2%

- 9.25%

- 9.3%

- 9.4%

- 9.45%

- 9.55%

- 9.9%

- 10.4%

- 11.2%

- 6.35%

- 6.4%

- 0%

- 5.75%

- 5.8%

- 6%

- 6%

- 6.5%

- 7%

- 7.5%

- 8%

- 8.5%

- 4%

- 6%

- 7%

- 7.75%

- 8%

- 8.9%

- 9%

- 4%

- 4.25%

- 4.5%

- 6%

- 7%

- 8%

- 8.5%

- 9%

- 6.25%

- 6.3%

- 6.5%

- 6.6%

- 6.75%

- 6.85%

- 7%

- 7.1%

- 7.25%

- 7.35%

- 7.5%

- 7.6%

- 7.75%

- 7.85%

- 8%

- 8.1%

- 8.25%

- 8.35%

- 8.5%

- 8.75%

- 8.85%

- 9%

- 9.25%

- 9.5%

- 9.75%

- 10%

- 10.25%

- 10.5%

- 10.75%

- 11%

- 7%

- 6%

- 7%

- 6.2%

- 6.5%

- 7%

- 7.25%

- 7.5%

- 7.65%

- 7.75%

- 7.9%

- 7.95%

- 7.975%

- 8%

- 8.1%

- 8.25%

- 8.45%

- 8.5%

- 8.6%

- 8.65%

- 8.75%

- 8.9%

- 8.95%

- 8.975%

- 9%

- 9.1%

- 9.125%

- 9.13%

- 9.15%

- 9.2%

- 9.225%

- 9.25%

- 9.3%

- 9.35%

- 9.4%

- 9.475%

- 9.5%

- 9.6%

- 9.65%

- 9.725%

- 9.75%

- 10%

- 10.5%

- 10.6%

- 6%

- 4%

- 4.45%

- 7.45%

- 7.7%

- 7.8%

- 7.95%

- 8%

- 8.075%

- 8.2%

- 8.45%

- 8.6%

- 8.7%

- 8.75%

- 8.8%

- 8.95%

- 9%

- 9.05%

- 9.075%

- 9.15%

- 9.2%

- 9.28%

- 9.4%

- 9.45%

- 9.575%

- 9.6%

- 9.7%

- 9.8%

- 9.85%

- 9.943%

- 9.95%

- 10%

- 10.116%

- 10.2%

- 10.44%

- 10.45%

- 10.95%

- 11.2%

- 11.45%

- 5.5%

- 6%

- 6.25%

- 6.3%

- 6%

- 6.875%

- 6.88%

- 6.9%

- 7.125%

- 7.13%

- 7.28%

- 7.375%

- 7.38%

- 7.525%

- 7.625%

- 7.63%

- 7.78%

- 7.875%

- 8.025%

- 8.125%

- 8.375%

- 7%

- 7.25%

- 8%

- 4.2%

- 4.725%

- 5.225%

- 5.35%

- 5.413%

- 5.45%

- 5.475%

- 5.6%

- 5.662%

- 5.675%

- 5.725%

- 5.825%

- 5.85%

- 5.891%

- 5.925%

- 5.95%

- 5.975%

- 6.1%

- 6.225%

- 6.308%

- 6.35%

- 6.391%

- 6.413%

- 6.425%

- 6.45%

- 6.475%

- 6.48%

- 6.6%

- 6.725%

- 6.73%

- 6.788%

- 6.85%

- 6.95%

- 6.975%

- 7.1%

- 7.2%

- 7.225%

- 7.35%

- 7.425%

- 7.45%

- 7.475%

- 7.6%

- 7.662%

- 7.725%

- 7.738%

- 7.8%

- 7.808%

- 7.85%

- 7.925%

- 7.95%

- 7.975%

- 8.05%

- 8.075%

- 8.1%

- 8.125%

- 8.225%

- 8.238%

- 8.288%

- 8.35%

- 8.413%

- 8.425%

- 8.45%

- 8.475%

- 8.488%

- 8.6%

- 8.68%

- 8.7%

- 8.725%

- 8.738%

- 8.85%

- 8.95%

- 8.975%

- 8.988%

- 9.038%

- 9.1%

- 9.2%

- 9.225%

- 9.238%

- 9.35%

- 9.475%

- 9.6%

- 9.679%

- 9.725%

- 9.738%

- 10.1%

- 0%

- 5.5%

- 6%

- 6.5%

- 7%

- 7.5%

- 4.6%

- 6.85%

- 7.1%

- 7.6%

- 7.725%

- 7.73%

- 8.1%

- 8.25%

- 8.265%

- 0%

- 6.625%

- 7%

- 5.1%

- 5.5%

- 5.688%

- 5.958%

- 6.063%

- 6.083%

- 6.125%

- 6.188%

- 6.313%

- 6.375%

- 6.438%

- 6.521%

- 6.563%

- 6.625%

- 6.688%

- 6.75%

- 6.771%

- 6.813%

- 6.833%

- 6.875%

- 6.938%

- 7.125%

- 7.188%

- 7.25%

- 7.313%

- 7.375%

- 7.438%

- 7.563%

- 7.583%

- 7.625%

- 7.646%

- 7.688%

- 7.75%

- 7.771%

- 7.813%

- 7.833%

- 7.875%

- 7.896%

- 7.938%

- 8%

- 8.125%

- 8.146%

- 8.188%

- 8.25%

- 8.271%

- 8.313%

- 8.375%

- 8.396%

- 8.438%

- 8.5%

- 8.563%

- 8.625%

- 8.938%

- 9.063%

- 9.25%

- 4%

- 4.375%

- 7%

- 7.375%

- 7.5%

- 8%

- 8.125%

- 8.25%

- 8.375%

- 8.5%

- 8.625%

- 8.75%

- 8.875%

- 8.88%

- 4.8%

- 6.75%

- 7%

- 7.25%

- 7.5%

- 5%

- 5.25%

- 5.5%

- 6%

- 6.5%

- 7%

- 7.25%

- 7.5%

- 7.75%

- 8%

- 8.5%

- 5.8%

- 6.5%

- 6.75%

- 7%

- 7.25%

- 7.5%

- 8%

- 4.5%

- 4.75%

- 4.85%

- 4.867%

- 4.875%

- 5%

- 5.125%

- 5.15%

- 5.167%

- 5.2%

- 5.25%

- 5.313%

- 5.375%

- 5.4%

- 5.5%

- 5.75%

- 5.8%

- 5.85%

- 5.875%

- 5.9%

- 5.917%

- 5.95%

- 5.995%

- 6%

- 6.083%

- 6.25%

- 6.333%

- 6.5%

- 6.583%

- 6.75%

- 7%

- 7.125%

- 7.15%

- 7.5%

- 7.75%

- 7.875%

- 7.917%

- 8%

- 8.15%

- 8.2%

- 8.25%

- 8.35%

- 8.375%

- 8.38%

- 8.4%

- 8.417%

- 8.5%

- 8.517%

- 8.625%

- 8.667%

- 8.7%

- 8.75%

- 8.813%

- 8.85%

- 8.875%

- 8.9%

- 8.917%

- 8.95%

- 8.975%

- 8.995%

- 9%

- 9.085%

- 9.1%

- 9.125%

- 9.15%

- 9.167%

- 9.2%

- 9.25%

- 9.3%

- 9.333%

- 9.35%

- 9.375%

- 9.4%

- 9.495%

- 9.5%

- 9.583%

- 9.625%

- 9.667%

- 9.75%

- 9.8%

- 9.85%

- 9.875%

- 9.917%

- 9.95%

- 9.967%

- 9.995%

- 10%

- 10.083%

- 10.15%

- 10.167%

- 10.25%

- 10.333%

- 10.375%

- 10.5%

- 10.65%

- 11%

- 11.5%

- 0%

- 6%

- 7%

- 8%

- 7%

- 6%

- 7%

- 8%

- 9%

- 4%

- 4.5%

- 5.5%

- 6.5%

- 7%

- 8.5%

- 8.75%

- 9%

- 9.25%

- 9.5%

- 9.75%

- 12%

- 6.25%

- 6.3%

- 6.5%

- 6.75%

- 7%

- 7.25%

- 7.5%

- 7.75%

- 8%

- 8.125%

- 8.25%

- 4.7%

- 6.05%

- 6.1%

- 6.2%

- 6.35%

- 6.4%

- 6.45%

- 6.5%

- 6.6%

- 6.65%

- 6.7%

- 6.75%

- 6.85%

- 6.9%

- 6.95%

- 7%

- 7.1%

- 7.15%

- 7.25%

- 7.35%

- 7.45%

- 7.5%

- 7.6%

- 7.75%

- 7.8%

- 7.95%

- 8.1%

- 8.2%

- 8.25%

- 8.75%

- 8.85%

- 6%

- 7%

- 4.3%

- 5.3%

- 6%

- 7%

- 6.5%

- 7%

- 7.5%

- 7.6%

- 7.7%

- 7.8%

- 7.9%

- 8%

- 8.1%

- 8.2%

- 8.3%

- 8.4%

- 8.5%

- 8.6%

- 8.7%

- 8.8%

- 8.9%

- 8.98%

- 9%

- 9.1%

- 9.2%

- 9.3%

- 9.8%

- 9.9%

- 10%

- 10.1%

- 10.2%

- 10.4%

- 10.5%

- 6%

- 7%

- 5%

- 5.1%

- 5.5%

- 5.6%

- 4%

- 5%

- 5.25%

- 6%

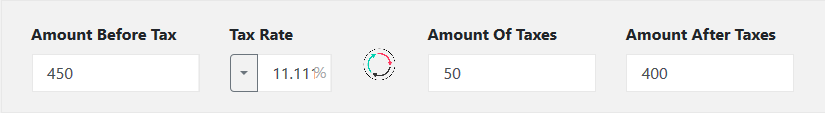

- Amount Before Tax ${{amountBeforeTax}}

- Sales Tax Rate {{SalesTaxRate}}%

- Amount Of Taxes ${{AmountOfTaxes}}

- Amount After Taxes ${{AmountAfterTaxes}}

Sales tax can sometimes be annoying when it's hard to deduce what bill you will be charged at a restaurant or when you are about to buy something on sale, but it gets out of your budget after hefty sales tax is added to its price.

To prevent such unwanted situations, you need a brain like Einstein to remember all sales tax rates and perform instant calculations.

We know everyone isn't blessed with such a brain!

Don't worry! DrEmployee has got you covered!

Our team of experts has forged a tool to solve multiple problems around the tax, like deducing the gross price of a product based on the net price and the tax rate according to the location, or vice versa as a Reverse Sales Tax Calculator. And for this all you need is to follow the steps below:

How to use our Sales Tax Calculator? – A step by Step Guide

Our sales tax calculator is divided into three following sections to ensure the ultimate user experience:

- Section 1: Location

- Section 2: Gross Price, Tax rate, Tax amount and Net Price of a Product

- Section 3: Representing the results in the form or List and Graph

As the Sales tax rate is different depending on the state in the United States and the base of the tax, first, you need to select your State in section 1 from the drop-down menu.

Step 2:

Calculate "Amount of Taxes" and "Amount after Taxes (Net Price)" by entering "Amount before Tax" of a product and selecting "Tax Rate" or entering your desired "Tax Rate."

- To calculate Sales Tax accurately, you are required to add both State and Local Sales tax rates.

- You can use "Clear" button to reset the calculator to default.

Once you have completed Step 1 and Step 2, you will see a detailed answer in the form of List and Graph in section 3 (as shown in the image below):

How to use our Reverse Sales Tax Calculator?

Fortunately, you aren't required to jump over pages, sections or use a separate Reverse Sales Tax Calculator to determine the price of a product before sales tax. All you need to do is to work other way around by following the steps below:

Step 1:

Select your State in section 1 from the drop-down menu.

Step 2:

No enter or select "Tax Rate" and "Amount after Taxes" to calculate "Amount before Tax (Gross Price)" of a product.

Step 3:

Once you have completed Step 1 and Step 2, you will see a detailed answer in the form of List and Graph in section 3 (as shown in the image below):

If you need more insight into this topic, you must continue reading!

What is the Sales Tax?

Basically, Sales Tax is a consumption-based tax charged on sales or on the receipts from sales of a good or service, which is calculated by multiplying the purchase price by the applicable tax rate. The most commonly applied Sales Tax is the Retail Sales Tax, indirectly collected by the authorities from the customers through sellers. However, there are a few other types of sales tax too.

Who charges the tax, how it's remitted, and who it's remitted to, all depend on where you are in the world.

In the United States, no National or Federal Sales Tax exists. However, it is governed at the state level and further at local governments level (like counties, cities, and special districts), which means sales tax rates would differ from location to location, even which are only a few miles from each other.

45 among 50 states in the US, along with the District of Columbia, the territories of Puerto Rico, and Guam imposes Sales Tax, in addition to local government that charges additional sales tax. However, Delaware, New Hampshire, Alaska, Montana, and Oregon are the five states that don't levy Sales Tax.

Retail Sales tax is the most popular type of Sales Tax in the United States governed on the state level. The amount of this tax is added to the price of the product, which is then levied from the consumer by the seller. The sales tax amount is also printed on the receipt provided by the seller to the consumer. Then later seller manages all sales tax collected and transfers it to the authorities in compliance with state laws to avoid penalties and interest.

How to calculate Sales Tax:

You can calculate the final price (amount after sales tax) of a product by following the steps below:

Assume that a net price a Smartphone case is $50, and State sales tax along with local sales tax rate combined is 4.5%. The final price of a pen would be:

Step 1 - Multiply net price by sales tax rate: $50 x 4.5% = 2.25

Step 2 - Add the tax amount to the net price to find the final price after tax: 50 + 2.25 = $52.25

Don't have time calculating "amount after-tax"? You can skip the above steps and save time & effort by using our Sales Tax Calculator.

Sales Tax vs. Value-Added Tax (VAT)

Value Added Tax (VAT) is imposed in over 160 countries around the world except for the United States of America. Value Added Tax (VAT) is not as straight forward as the General Sales Tax.

It is charged incrementally on the price of the product at each stage of production, distribution, or sale to the end consumer. Ultimately, the consumer bears all taxes as the buyers earlier in the chain of production receives reimbursement for previous VAT Taxes paid. On the other hand, Sales tax is charged directly to the consumer of the product by the seller.

In both Sales tax and Value Added Tax, the ultimate tax burden is charged on the consumer. However, the process of collecting, administration, and effects on the economy are different.

Advantages of Sales Tax over Value Added Tax(VAT):

- Sales Tax framework is significantly less complex than VAT.

- Easy and cheap to administer.

Advantages of Value Added Tax(VAT) over Sales Tax:

- More secure and prevents tax evasion or malpractice.

- Costly to administer compared to sales tax.

- No chances of double taxation.

- Affects lower-income earners more disproportionately.

- It doesn't tax businesses more to reduce the tax burden on the end consumer.

Sales Tax vs. Use Tax

Use taxes are functionally equivalent to sales taxes. However, they are only imposed on buyers of taxable items, property, or services where sales tax is not paid. So you will pay either sales tax or use tax but neither both.

For example, if a person buys an item from the Oregon State that doesn't charge sales tax, and bring it to Washington State than he/she owes the Washington Use Tax for using the item in Washington.

Use Tax is calculated at the same rate as sales tax, combining both State and Local Sales Taxes. So if you want to calculate Use Tax, you are free to use our Sales Tax Calculator. Once you have estimated the consumer use tax, you can easily file the consumer use tax return on the official site provided by your relevant state.

Sales Tax Calculator vs. Reverse Sales Tax Calculator

To deduce the original price (before sales tax) of a product or to file an accurate tax return or to claim overpaid sales taxes, you need to know how much you have paid for.

The simplest way to know this is by using the Reverse Sales Tax Calculator. This calculator works exactly in the reverse process of the Sales Tax calculator and can be quite useful.

Advantages of using Reverse Sales Tax Calculator

Are you thinking of how a "Reverse Sales Tax Calculator" is useful? Well! Following are few among many advantages of using Reverse Sales Tax Calculator:

- Useful while you itemize your deductions and then claiming overpaid local sales taxes and out-of-state sales taxes.

- Instantly deduce the price of a product before taxes.

- Quickly verify the amount of sales tax indicated on your item's receipt.

How to calculate reverse sales tax from the total amount on a receipt?

Whether you are calculating the sales tax from the purchase amount, or calculate the reverse sales tax, then separate this amount from the total amount, the computations remain the same. However, the "reverse sales tax calculation from the total" method is a lot easier.

Here is how it works manually with the following steps:

Let's assume you have bought two chocolates from a store by paying a total amount of $10, where $1 was charged as Sales Tax. Therefore, calculate the "amount before taxes" for two chocolates by:

Step 1 - Subtract the sales tax paid from the total amount: $10 - $1 = $9

Step 2 - Divide the sales tax paid by the price of the chocolates before tax: $1 / $9 = 0.11

Step 3 - Convert the sales tax rate into a percentage value: 0.11 x 100 = 11.1%

Assuming that you already know the chocolate's post-tax price as well as the tax rate you've assessed, let's perform a backward calculation to deduce the amount of sales tax:

Step 1 - Add 100% to the value of the tax rate: 100% + 11.1% = 111.1%

Step 2 - Convert the value of the total percentage into decimal form: 111.1 / 100 = 1.111

Step 3 - Divide the price of the chocolates post-tax by the decimal value: $10 / 1.111 = $9.0

Step 4 - Subtract the price of the chocolates pre-tax to the price of the item post-tax: $10 - $9 = $1

So it is proved that the tax amount you've seen on the receipt matches the final tax amount you've deduced using reverse sales tax calculation. As this method involves a lot of steps, it is recommended to use our Reverse Sales Tax Calculator.

How to find the price of a product before tax using Reverse Sales Tax Calculation Formula?

Although, you can find the original price of a product before tax within seconds using our Sales Tax calculator, here is how to do it manually:

Original Price with Sales Tax = [Original Price × (Sales Tax rate in decimal form + 1)]

For example:

John bought a pair of running shoes from a store by paying $50. According to the receipt, he was charged 10% of Sales Tax. Now, the original price (price before sales tax) of running shoes can be calculated using a reverse sales tax calculation formula:

Original Price with Sales Tax = [Original Price × (Sales Tax rate in decimal form + 1)]

$50 = [Original Price × (10/100 + 1)]

50 = Original Price x 1.1

50/1.1 = Original Price

$45.5 = Original Price

How to find the original Price of a product after a discount or decrease in percentage?

There are times when we buy a product from sale, which is also subjected to sales tax. If you are in need to deduce its original price, you can follow the steps below:

Assume you bought a smartphone at the price of $400 on Black Friday sale, offering a discount of flat 30%. Now the original price (before discount and sales tax) of a smartphone using a reverse sales tax calculation method would be:

Step 1 - Subtract the discount rate from 100% to acquire the original price's percentage: 100% - 30% = 70%

Step 2 - Multiply the final price of the item by 100: 400 x 100 = 40000

Step 3 - Finally, divide the percentage value you acquired in the first step: 40000 / 70 = $571.4

Some Useful Definitions of the terms used in Sales Tax Calculation:

1. Taxable Value:

It is an amount of product or service which is subjected to Sales Tax. It is generally the net selling price of a product or service. However, some states offer exemption from tax on a purchase price or portion of sales for some types of goods.

2. Taxable Goods:

Taxable goods are a class of goods subjected to sales tax by a state. Not all goods are taxable goods, as the state law exempts some.

Sales Tax by State 2025

45 among 50 states collect sales tax at the state level, and 38 among 50 states collect local sales taxes. Each state with a sales tax has a statewide sales tax rate. The state uses the funding from this tax for the development of the state like road and Public safety. The Sales tax rates range between 0% to 16% depending on the state and the type of good or service.

Additionally, some states also allow local counties and cities to set a sales tax rate. In this case, products are subjected to State Sales Tax as well as Local Sales Tax depending on which city or county they are for sale.

Some states may also impose a special tax on the district level if they fall short in budget, or they collaborate with several surrounding areas to create a special, limited-time sales tax for paying any publicly-funded venture like a rail system, park or school.

|

(a) City, county and municipal rates vary. These rates are weighted by population to compute an average local tax rate. (b) Three states levy mandatory, statewide, local add-on sales taxes at the state level: California (1%), Utah (1.25%), and Virginia (1%). We include these in their state sales tax. (c) The sales taxes in Hawaii, New Mexico, and South Dakota have broad bases that include many business-to-business services. (d) Special taxes in local resort areas are not counted here. (e) Salem County, N.J., is not subject to the statewide sales tax rate and collects a local rate of 3.3125%. New Jersey’s local score is represented as a negative. Sources: Sales Tax Clearinghouse; Tax Foundation calculations; State Revenue Department websites. |

||||||

| State | State Tax Rate | Rank | Avg. Local Tax Rate (a) | Combined Rate | Rank | Max Local Tax Rate |

|---|---|---|---|---|---|---|

| Alabama | 4.00% | 40 | 5.24% | 9.24% | 5 | 7.50% |

| Alaska | 0.00% | 46 | 1.76% | 1.76% | 46 | 7.50% |

| Arizona | 5.60% | 28 | 2.80% | 8.40% | 11 | 5.60% |

| Arkansas | 6.50% | 9 | 2.97% | 9.47% | 3 | 6.125% |

| California (b) | 7.25% | 1 | 1.57% | 8.82% | 7 | 2.50% |

| Colorado | 2.90% | 45 | 4.87% | 7.77% | 16 | 8.30% |

| Connecticut | 6.35% | 12 | 0.00% | 6.35% | 33 | 0.00% |

| Delaware | 0.00% | 46 | 0.00% | 0.00% | 47 | 0.00% |

| D.C. | 6.00% | (17) | 0.00% | 6.000% | (38) | 0.00% |

| Florida | 6.00% | 17 | 1.01% | 7.01% | 23 | 2.00% |

| Georgia | 4.00% | 40 | 3.35% | 7.35% | 19 | 4.90% |

| Hawaii (c) | 4.00% | 40 | 0.44% | 4.44% | 45 | 0.50% |

| Idaho | 6.00% | 17 | 0.02% | 6.02% | 37 | 3.00% |

| Illinois | 6.25% | 13 | 2.56% | 8.81% | 8 | 4.75% |

| Indiana | 7.00% | 2 | 0.00% | 7.00% | 24 | 0.00% |

| Iowa | 6.00% | 17 | 0.94% | 6.94% | 28 | 1.00% |

| Kansas | 6.50% | 9 | 2.20% | 8.70% | 9 | 4.00% |

| Kentucky | 6.00% | 17 | 0.00% | 6.00% | 38 | 0.00% |

| Louisiana | 4.45% | 38 | 5.10% | 9.55% | 1 | 7.00% |

| Maine | 5.50% | 29 | 0.00% | 5.50% | 42 | 0.00% |

| Maryland | 6.00% | 17 | 0.00% | 6.00% | 38 | 0.00% |

| Massachusetts | 6.25% | 13 | 0.00% | 6.25% | 35 | 0.00% |

| Michigan | 6.00% | 17 | 0.00% | 6.00% | 38 | 0.00% |

| Minnesota | 6.875% | 6 | 0.61% | 7.49% | 17 | 2.00% |

| Mississippi | 7.00% | 2 | 0.07% | 7.07% | 22 | 1.00% |

| Missouri | 4.225% | 39 | 4.06% | 8.29% | 12 | 5.763% |

| Montana (d) | 0.00% | 46 | 0.00% | 0.00% | 47 | 0.00% |

| Nebraska | 5.50% | 29 | 1.44% | 6.94% | 29 | 2.50% |

| Nevada | 6.85% | 7 | 1.38% | 8.23% | 13 | 1.53% |

| New Hampshire | 0.00% | 46 | 0.00% | 0.00% | 47 | 0.00% |

| New Jersey (e) | 6.625% | 8 | -0.03% | 6.60% | 30 | 3.313% |

| New Mexico (c) | 5.125% | 32 | 2.71% | 7.84% | 15 | 4.313% |

| New York | 4.00% | 40 | 4.52% | 8.52% | 10 | 4.875% |

| North Carolina | 4.75% | 35 | 2.23% | 6.98% | 26 | 2.75% |

| North Dakota | 5.00% | 33 | 1.96% | 6.96% | 27 | 3.50% |

| Ohio | 5.75% | 27 | 1.47% | 7.22% | 20 | 2.25% |

| Oklahoma | 4.50% | 36 | 4.47% | 8.97% | 6 | 7.00% |

| Oregon | 0.00% | 46 | 0.00% | 0.00% | 47 | 0.00% |

| Pennsylvania | 6.00% | 17 | 0.34% | 6.34% | 34 | 2.00% |

| Rhode Island | 7.00% | 2 | 0.00% | 7.00% | 24 | 0.00% |

| South Carolina | 6.00% | 17 | 1.44% | 7.44% | 18 | 3.00% |

| South Dakota (c) | 4.50% | 36 | 1.90% | 6.40% | 32 | 4.50% |

| Tennessee | 7.00% | 2 | 2.55% | 9.55% | 2 | 2.75% |

| Texas | 6.25% | 13 | 1.95% | 8.20% | 14 | 2.00% |

| Utah (b) | 6.10% | 16 | 1.09% | 7.19% | 21 | 2.95% |

| Vermont | 6.00% | 17 | 0.24% | 6.24% | 36 | 1.00% |

| Virginia (b) | 5.30% | 31 | 0.45% | 5.75% | 41 | 0.70% |

| Washington | 6.50% | 9 | 2.79% | 9.29% | 4 | 4.00% |

| West Virginia | 6.00% | 17 | 0.52% | 6.52% | 31 | 1.00% |

| Wisconsin | 5.00% | 33 | 0.43% | 5.43% | 43 | 1.75% |

| Wyoming | 4.00% | 40 | 1.22% | 5.22% | 44 | 2.00% |

FAQs

Answer: Sales Tax in the United States are generally administered at the state level. However, some states also have counties and cities that impose an additional local sales tax.

Answer: Tennessee State has the highest average combined state and local sales tax rates of 9.47%. Whereas, California has the highest state-level sales tax rate of at 7.25 percent.

Answer: The state with the lowest average combined state and local rates is Alaska, having 1.76 percent of Sales Tax.

Answer: No, the United States doesn't charge any Value Added Tax.

Answer: New Hampshire, Oregon, Delaware, Montana, and Alaska are the sales-tax-free states in the US.

Other States

- Alabama-AL Sales/Reverse Sales Tax Calculator

- Alaska-AK Sales/Reverse Sales Tax Calculator

- Arizona-AZ Sales/Reverse Sales Tax Calculator

- Arkansas-AR Sales/Reverse Sales Tax Calculator

- California-CA Sales/Reverse Sales Tax Calculator

- Colorado-CO Sales/Reverse Sales Tax Calculator

- Connecticut-CT Sales/Reverse Sales Tax Calculator

- Delaware-DE Sales/Reverse Sales Tax Calculator

- Florida-FL Sales/Reverse Sales Tax Calculator

- Georgia-GA Sales/Reverse Sales Tax Calculator

- Hawaii-HI Sales/Reverse Sales Tax Calculator

- Idaho-ID Sales/Reverse Sales Tax Calculator

- Illinois-IL Sales/Reverse Sales Tax Calculator

- Indiana-IN Sales/Reverse Sales Tax Calculator

- Iowa-IA Sales/Reverse Sales Tax Calculator

- Kansas-KS Sales/Reverse Sales Tax Calculator

- Kentucky-KY Sales/Reverse Sales Tax Calculator

- Louisiana-LA Sales/Reverse Sales Tax Calculator

- Maine-ME Sales/Reverse Sales Tax Calculator

- Maryland-MD Sales/Reverse Sales Tax Calculator

- Massachusetts-MA Sales/Reverse Sales Tax Calculator

- Michigan-MI Sales/Reverse Sales Tax Calculator

- Minnesota-MN Sales/Reverse Sales Tax Calculator

- Mississippi-MS Sales/Reverse Sales Tax Calculator

- Missouri-MO Sales/Reverse Sales Tax Calculator

- Montana-MT Sales/Reverse Sales Tax Calculator

- Nebraska-NE Sales/Reverse Sales Tax Calculator

- Nevada-NV Sales/Reverse Sales Tax Calculator

- New Hampshire-NH Sales/Reverse Sales Tax Calculator

- New Jersey-NJ Sales/Reverse Sales Tax Calculator

- New Mexico-NM Sales/Reverse Sales Tax Calculator

- New York-NY Sales/Reverse Sales Tax Calculator

- North Carolina-NC Sales/Reverse Sales Tax Calculator

- North Dakota-ND Sales/Reverse Sales Tax Calculator

- Ohio-OH Sales/Reverse Sales Tax Calculator

- Oklahoma-OK Sales/Reverse Sales Tax Calculator

- Oregon-OR Sales/Reverse Sales Tax Calculator

- Pennsylvania-PA Sales/Reverse Sales Tax Calculator

- Rhode Island-RI Sales/Reverse Sales Tax Calculator

- South Carolina-SC Sales/Reverse Sales Tax Calculator

- South Dakota-SD Sales/Reverse Sales Tax Calculator

- Tennessee-TN Sales/Reverse Sales Tax Calculator

- Texas-TX Sales/Reverse Sales Tax Calculator

- Utah-UT Sales/Reverse Sales Tax Calculator

- Vermont-VT Sales/Reverse Sales Tax Calculator

- Virginia-VA Sales/Reverse Sales Tax Calculator

- Washington-WA Sales/Reverse Sales Tax Calculator

- West Virginia-WV Sales/Reverse Sales Tax Calculator

- Wisconsin-WI Sales/Reverse Sales Tax Calculator

- Wyoming-WY Sales/Reverse Sales Tax Calculator