Sales Tax and Reverse Sales Tax Calculator Minnesota

(Tax Year 2026: Last Updated on January 30, 2026)

Minnesota's state general sales tax rate is 6.875%. Minnesota allows counties, cities, and/or municipalities to levy a local sales tax of up to 2% at their discretion. The Minnesota sales tax and the reverse sales tax may both be calculated using this calculator. Currently, the only details you need to supply to get results are the amount before taxes, the amount after taxes, and the tax rate.

- 6.875%

- 6.88%

- 6.9%

- 7.125%

- 7.13%

- 7.28%

- 7.375%

- 7.38%

- 7.525%

- 7.625%

- 7.63%

- 7.78%

- 7.875%

- 8.025%

- 8.125%

- 8.375%

- Amount Before Tax ${{amountBeforeTax}}

- Sales Tax Rate {{SalesTaxRate}}%

- Amount Of Taxes ${{AmountOfTaxes}}

- Amount After Taxes ${{AmountAfterTaxes}}

Minnesota – MN Sales Tax Calculator: User Guide

Minnesota, dubbed as "Land of 10,000 Lakes", is a state located in the midwestern region of United States, sharing its borders with Canada and Lake Superior, the largest of the Great Lakes.

Whether you're interested in starting, relocating, or expanding your business, Minnesota has it all! It has a flourishing economy, a favorable business environment, and plenty of employment opportunities.

For having business in Minnesota, it is essential to know everything about MN Sales Tax. We have compiled a comprehensive guide packed with a handy MN Sales Tax Calculator, which includes the sales tax facts, laws, rates, and a simple method to calculate Minnesota Sales Tax.

So let's get started!

Minnesota Sales Tax Facts:

- The sales tax rate levied on the state level in Minnesota is 6.875%. Moreover, additional sales tax is also levied by counties and cities where rates range between 0% and 2%.

- In some exceptional cases, a special sales tax rate may also apply that range between 0% and 2%.

- Duluth, Minnesota, is among cities that charge the highest combined (state+local) sales tax rate of 8.875%.

- Arlington, Minnesota, is among cities that charge the lowest combined sales tax rate of 6.875%.

- Some of the tax type charged in Minnesota includes Consumers use, sales tax, rental tax, sellers use, lodgings tax, and more.

- Most of the clothing, prescription drugs, and raw groceries are exempted from the Minnesota Sales Tax.

- Entertainment, Restaurants, and Alcoholic beverages are charged with a surtax of up to 3%, which raises the sales tax rate up to 9.875% in Minnesota. Moreover, Mankato and Proctor also levy additional surtax of 0.5% and 1% respectively on food and beverages.

- Many services, including laundry services, parking services, installations, and telecommunications services, are also subjected to Minnesota sales tax.

- Goods purchased for resale, improvement, or as raw materials by individuals and companies can be exempted from MN Sales Tax by using Minnesota Sales Tax Exemption Form.

- Taxable goods and services used in Minnesota, where no sales tax was paid at the time of purchase, are supposed to be subjected to Minnesota Use Tax.

How to calculate Sales Tax in Minnesota?

Businesses and Sellers who have Nexus are required to pay Sales tax to Minnesota (state and local) on the retail sales of tangible personal property and the sales of most services. They are required to collect, manage, and transfers it to the Minnesota Department of Revenue while staying in compliance with state laws and avoid penalties and interest.

The sales tax determined on four factors:

- Nexus: It is a connection of business with a state. The business is only liable to pay taxes to the states with Nexus.

- Location and Products or Services: The sales tax rate varies from product to product and location to location. You must check the sales tax rate applicable to your product according to the product category, county, and city in Minnesota.

- Exemptions: Almost all goods are eligible for sales tax regulation. However, products, including most clothing, prescription drugs, raw groceries, and few more, are exempted under Minnesota Law. So you should check with Minnesota state government as to which goods and services sold in Minnesota are subject to sales tax.

To calculate Sales Tax in Minnesota, follow the steps below:

Step 1 – Determine your Nexus:

As a business owner, you are only required to collect sales tax if you are eligible for collecting sales tax and have Sales Tax Nexus in the Minnesota State. And to determine your Nexus in Minnesota, you must have any of the following:

- A physical location directly or by a subsidiary like an office, distribution, sales, sample room location, or other business places.

- A permanent or temporary employee like a representative, agent, salesperson, canvasser, or a solicitor working for you in the state.

- Using your own vehicle to deliver items in Minnesota.

- Proving taxable services in the state.

- Selling a product through online stores, internet, email, or telephone to customers in Minnesota, without having any physical location in the state and does not meet the small seller exemption.

- Generated 200 or more or a total of more than $100,000 of retail sales in a year.

- Ownership of property in Minnesota and a few more.

Step 2 – Determine the Sales Tax Rate:

Once you have determined that your Nexus is with Minnesota, next is to deduce the Sales Tax rate (State + Local Sales Tax) applicable on your product, for which you can refer the tables below:

Minnesota Sales Tax Rates by Location:

The state-wide Sales Tax rate in Minnesota is 6.875%. Besides, many cities and counties levy additional local sales tax on tangible personal property and most services.

Note:

- Local Sales Tax rates charged by cities in Minnesota may vary according to the type of purchases and location.

Following are the Sales Tax rate on State, County, and city-level in Minnesota:

| County | State Rate | County Rate | Total Sales Tax |

|---|---|---|---|

| Aitkin | 6.875% | 0.00% | 6.875% |

| Anoka | 6.875% | 0.25% | 7.125% |

| Becker | 6.875% | 0.50% | 7.375% |

| Beltrami | 6.875% | 0.50% | 7.375% |

| Benton | 6.875% | 0.50% | 7.375% |

| Big Stone | 6.875% | 0.00% | 6.875% |

| Blue Earth | 6.875% | 0.50% | 7.375% |

| Brown | 6.875% | 0.50% | 7.375% |

| Carlton | 6.875% | 0.50% | 7.375% |

| Carver | 6.875% | 0.50% | 7.375% |

| Cass | 6.875% | 0.50% | 7.375% |

| Chippewa | 6.875% | 0.00% | 6.875% |

| Chisago | 6.875% | 0.50% | 7.375% |

| Clay | 6.875% | 0.50% | 7.375% |

| Clearwater | 6.875% | 0.00% | 6.875% |

| Cook | 6.875% | 1.50% | 8.375% |

| Cottonwood | 6.875% | 0.00% | 6.875% |

| Crow Wing | 6.875% | 0.50% | 7.375% |

| Dakota | 6.875% | 0.25% | 7.125% |

| Dodge | 6.875% | 0.50% | 7.375% |

| Douglas | 6.875% | 0.50% | 7.375% |

| Faribault | 6.875% | 0.00% | 6.875% |

| Fillmore | 6.875% | 0.50% | 7.375% |

| Freeborn | 6.875% | 0.50% | 7.375% |

| Goodhue | 6.875% | 0.50% | 7.375% |

| Grant | 6.875% | 0.00% | 6.875% |

| Hennepin | 6.875% | 0.65% | 7.525% |

| Houston | 6.875% | 0.00% | 6.875% |

| Hubbard | 6.875% | 0.50% | 7.375% |

| Isanti | 6.875% | 0.50% | 7.375% |

| Itasca | 6.875% | 0.00% | 6.875% |

| Jackson | 6.875% | 0.00% | 6.875% |

| Kanabec | 6.875% | 0.50% | 7.375% |

| Kandiyohi | 6.875% | 0.50% | 7.375% |

| Kittson | 6.875% | 0.00% | 6.875% |

| Koochiching | 6.875% | 0.00% | 6.875% |

| Lac qui Parle | 6.875% | 0.00% | 6.875% |

| Lake | 6.875% | 0.50% | 7.375% |

| Lake of the Woods | 6.875% | 0.00% | 6.875% |

| Le Sueur | 6.875% | 0.00% | 6.875% |

| Lincoln | 6.875% | 0.00% | 6.875% |

| Lyon | 6.875% | 0.50% | 7.375% |

| Mahnomen | 6.875% | 0.00% | 6.875% |

| Marshall | 6.875% | 0.00% | 6.875% |

| Martin | 6.875% | 0.00% | 6.875% |

| McLeod | 6.875% | 0.50% | 7.375% |

| Meeker | 6.875% | 0.00% | 6.875% |

| Mille Lacs | 6.875% | 0.50% | 7.375% |

| Morrison | 6.875% | 0.50% | 7.375% |

| Mower | 6.875% | 0.50% | 7.375% |

| Murray | 6.875% | 0.00% | 6.875% |

| Nicollet | 6.875% | 0.50% | 7.375% |

| Nobles | 6.875% | 0.00% | 6.875% |

| Norman | 6.875% | 0.00% | 6.875% |

| Olmsted | 6.875% | 0.50% | 7.375% |

| Otter Tail | 6.875% | 0.50% | 7.375% |

| Pennington | 6.875% | 0.00% | 6.875% |

| Pine | 6.875% | 0.50% | 7.375% |

| Pipestone | 6.875% | 0.00% | 6.875% |

| Polk | 6.875% | 0.25% | 7.125% |

| Pope | 6.875% | 0.00% | 6.875% |

| Ramsey | 6.875% | 0.50% | 7.375% |

| Red Lake | 6.875% | 0.00% | 6.875% |

| Redwood | 6.875% | 0.50% | 7.375% |

| Renville | 6.875% | 0.00% | 6.875% |

| Rice | 6.875% | 0.50% | 7.375% |

| Rock | 6.875% | 0.00% | 6.875% |

| Roseau | 6.875% | 0.00% | 6.875% |

| Scott | 6.875% | 0.50% | 7.375% |

| Sherburne | 6.875% | 0.50% | 7.375% |

| Sibley | 6.875% | 0.00% | 6.875% |

| St. Louis | 6.875% | 0.50% | 7.375% |

| Stearns | 6.875% | 0.25% | 7.125% |

| Steele | 6.875% | 0.50% | 7.375% |

| Stevens | 6.875% | 0.00% | 6.875% |

| Swift | 6.875% | 0.00% | 6.875% |

| Todd | 6.875% | 0.50% | 7.375% |

| Traverse | 6.875% | 0.00% | 6.875% |

| Wabasha | 6.875% | 0.50% | 7.375% |

| Wadena | 6.875% | 0.50% | 7.375% |

| Waseca | 6.875% | 0.50% | 7.375% |

| Washington | 6.875% | 0.25% | 7.125% |

| Watonwan | 6.875% | 0.00% | 6.875% |

| Wilkin | 6.875% | 0.00% | 6.875% |

| Winona | 6.875% | 0.50% | 7.375% |

| Wright | 6.875% | 0.50% | 7.375% |

| Yellow Medicine | 6.875% | 0.00% | 6.875% |

| City | State Rate | County + City Rate | Total Sales Tax |

|---|---|---|---|

| Albert Lea | 6.875% | 1.000% | 7.875% |

| Alexandria | 6.875% | 0.500% | 7.375% |

| Andover | 6.875% | 0.250% | 7.125% |

| Anoka | 6.875% | 0.250% | 7.125% |

| Apple Valley | 6.875% | 0.250% | 7.125% |

| Arden Hills | 6.875% | 0.500% | 7.375% |

| Austin | 6.875% | 1.000% | 7.875% |

| Bemidji | 6.875% | 1.000% | 7.875% |

| Big Lake | 6.875% | 0.500% | 7.375% |

| Blaine | 6.875% | 0.250% | 7.125% |

| Bloomington | 6.875% | 0.650% | 7.525% |

| Brainerd | 6.875% | 1.000% | 7.875% |

| Brooklyn Center | 6.875% | 0.650% | 7.525% |

| Brooklyn Park | 6.875% | 0.650% | 7.525% |

| Buffalo | 6.875% | 0.500% | 7.375% |

| Burnsville | 6.875% | 0.250% | 7.125% |

| Champlin | 6.875% | 0.650% | 7.525% |

| Chanhassen | 6.875% | 0.500% | 7.375% |

| Chaska | 6.875% | 0.500% | 7.375% |

| Cloquet | 6.875% | 1.000% | 7.875% |

| Columbia Heights | 6.875% | 0.250% | 7.125% |

| Coon Rapids | 6.875% | 0.250% | 7.125% |

| Cottage Grove | 6.875% | 0.250% | 7.125% |

| Crystal | 6.875% | 0.650% | 7.525% |

| Duluth | 6.875% | 2.000% | 8.875% |

| Eagan | 6.875% | 0.250% | 7.125% |

| East Bethel | 6.875% | 0.250% | 7.125% |

| Eden Prairie | 6.875% | 0.650% | 7.525% |

| Edina | 6.875% | 0.650% | 7.525% |

| Elk River | 6.875% | 0.500% | 7.375% |

| Fairmont | 6.875% | 0.500% | 7.375% |

| Faribault | 6.875% | 0.500% | 7.375% |

| Farmington | 6.875% | 0.250% | 7.125% |

| Fergus Falls | 6.875% | 1.000% | 7.875% |

| Forest Lake | 6.875% | 0.250% | 7.125% |

| Fridley | 6.875% | 0.250% | 7.125% |

| Golden Valley | 6.875% | 0.650% | 7.525% |

| Grand Rapids | 6.875% | 0.000% | 6.875% |

| Ham Lake | 6.875% | 0.250% | 7.125% |

| Hastings | 6.875% | 0.250% | 7.125% |

| Hermantown | 6.875% | 1.500% | 8.375% |

| Hibbing | 6.875% | 0.500% | 7.375% |

| Hopkins | 6.875% | 0.650% | 7.525% |

| Hugo | 6.875% | 0.250% | 7.125% |

| Hutchinson | 6.875% | 0.500% | 7.375% |

| Inver Grove Heights | 6.875% | 0.250% | 7.125% |

| Lakeville | 6.875% | 0.250% | 7.125% |

| Lino Lakes | 6.875% | 0.250% | 7.125% |

| Little Canada | 6.875% | 0.500% | 7.375% |

| Mankato | 6.875% | 1.000% | 7.875% |

| Maple Grove | 6.875% | 0.650% | 7.525% |

| Maplewood | 6.875% | 0.500% | 7.375% |

| Marshall | 6.875% | 1.000% | 7.875% |

| Mendota Heights | 6.875% | 0.250% | 7.125% |

| Minneapolis | 6.875% | 1.150% | 8.025% |

| Minnetonka | 6.875% | 0.650% | 7.525% |

| Monticello | 6.875% | 0.500% | 7.375% |

| Moorhead | 6.875% | 0.500% | 7.375% |

| Mounds View | 6.875% | 0.500% | 7.375% |

| New Brighton | 6.875% | 0.500% | 7.375% |

| New Hope | 6.875% | 0.650% | 7.525% |

| New Ulm | 6.875% | 1.000% | 7.875% |

| North Branch | 6.875% | 0.500% | 7.375% |

| North Mankato | 6.875% | 1.000% | 7.875% |

| North St. Paul | 6.875% | 0.500% | 7.375% |

| Northfield | 6.875% | 0.500% | 7.375% |

| Oakdale | 6.875% | 0.250% | 7.125% |

| Otsego | 6.875% | 0.500% | 7.375% |

| Owatonna | 6.875% | 0.500% | 7.375% |

| Plymouth | 6.875% | 0.650% | 7.525% |

| Prior Lake | 6.875% | 0.500% | 7.375% |

| Ramsey | 6.875% | 0.250% | 7.125% |

| Red Wing | 6.875% | 0.500% | 7.375% |

| Richfield | 6.875% | 0.650% | 7.525% |

| Robbinsdale | 6.875% | 0.650% | 7.525% |

| Rochester | 6.875% | 1.250% | 8.125% |

| Rogers | 6.875% | 0.650% | 7.525% |

| Rosemount | 6.875% | 0.250% | 7.125% |

| Roseville | 6.875% | 0.500% | 7.375% |

| Saint Paul | 6.875% | 1.000% | 7.875% |

| Sartell | 6.875% | 0.750% | 7.625% |

| Sauk Rapids | 6.875% | 0.500% | 7.375% |

| Savage | 6.875% | 0.500% | 7.375% |

| Shakopee | 6.875% | 0.500% | 7.375% |

| Shoreview | 6.875% | 0.500% | 7.375% |

| South St. Paul | 6.875% | 0.250% | 7.125% |

| St. Cloud | 6.875% | 0.750% | 7.625% |

| St. Louis Park | 6.875% | 0.500% | 7.375% |

| St. Michael | 6.875% | 0.500% | 7.375% |

| St. Peter | 6.875% | 0.500% | 7.375% |

| Stillwater | 6.875% | 0.250% | 7.125% |

| Vadnais Heights | 6.875% | 0.500% | 7.375% |

| Waconia | 6.875% | 0.500% | 7.375% |

| Waseca | 6.875% | 0.500% | 7.375% |

| West St. Paul | 6.875% | 0.750% | 7.625% |

| White Bear Lake | 6.875% | 0.500% | 7.375% |

| Willmar | 6.875% | 0.500% | 7.375% |

| Winona | 6.875% | 0.500% | 7.375% |

| Woodbury | 6.875% | 0.250% | 7.125% |

| Worthington | 6.875% | 0.000% | 6.875% |

Step 4 – Calculate Sales Tax:

After determining the sales tax rate according to the location and type of purchases, it is easy to calculate the sales tax amount charged on the product and gross price (amount after tax) of a product.

Example # 1:

For instance, you are selling a laptop bag on your store in Duluth, Minnesota, having a net price tag of $85. The amount that a buyer has to pay (including sales tax) on a check out would be:

Manual Method:

Net Price (amount before Tax) of a laptop bag: $85

Total Sales Tax rate: 1.50% (Duluth) + 0.50% (Saint Louis County) + 6.875% (Minnesota State) = 8.875%

Total Sales Tax amount = $85 x 8.875% = $7.5

Gross Price (Amount after Tax) = 85 + 7.5 = $92.5

It means the buyer has to pay for a laptop bag on a cash counter, which would be $92.5.

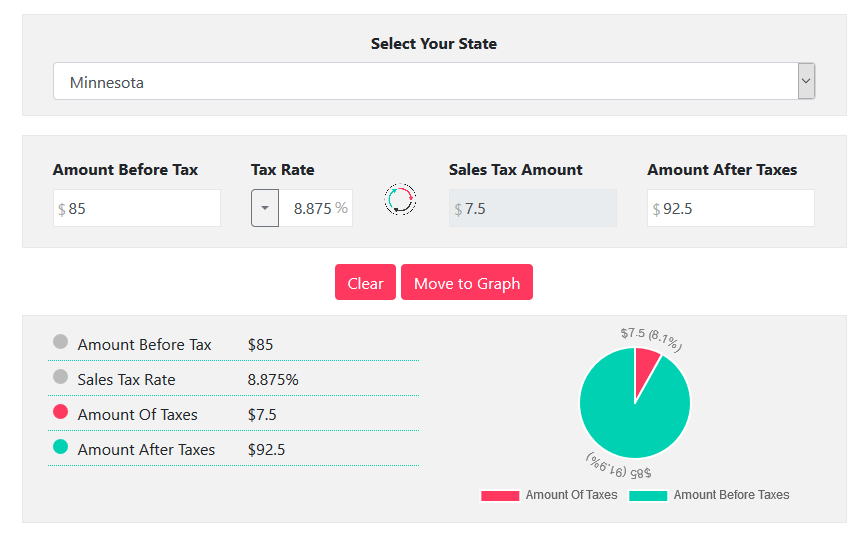

Using our Sales Tax Calculator:

All of the steps mentioned above can be skipped to get an instant result using our Sales Tax Calculator. All you need is:

- Input the $85 Net Price of a laptop bag as Amount Before Tax

- Input or select 875% of the combined Sales Tax rate on the Tax Rate menu.

Our calculator will automatically calculate the result, and represents it in 3 different forms, as shown in the image below:

Reverse Sales Tax Calculation

In the example above, we have explained to you to calculate the Sales Tax amount payable in a product, and the Gross Price of the Product.

But there are also instances when you are required to deduce how much sales tax buyer has actually paid on a product or you may want to check the accuracy of the sales tax indicated on your item's receipt.

This is where the Reverse Sales Tax Calculation Kicks in. And luckily, our Minnesota Sales Tax Calculator can perform this calculation like a Pro.

Example:

Your buyer has paid $35 for a laptop charger at your store in Maplewood, Minnesota. Now the buyer is inquiring how much the laptop charger actually cost before the sales tax was added. So you need to follow the steps below to determine the amount before tax (net price) of a laptop charger:

Gross Price (Amount after Tax) of laptop charger: $35

Total Sales Tax rate: 0.00% (Maplewood) + 0.50% (Ramsey County) + 6.875% (Minnesota State) = 7.375%

Manual Method:

Gross Price with sales tax = [Net Price × (tax rate in decimal form + 1)]

35 = [Net Price x ((7.375/100) + 1)]

35 = Net Price x 1.07

$32.7 = Net Price

So the original Price (net price) of the laptop charger was $32.7.

Using our Sales Tax Calculator:

You can also use our Sales Tax Calculator for Reverse Sales Tax calculation to skip the aforementioned manual method. All you need is:

- Input the $35 Gross Price of Laptop Charger as Amount after Tax

- Input or select 7.375% of combined Sales Tax Rate on the Tax Rate

Our calculator will automatically calculate the result and represents it in 3 different forms.

FAQs

Answer: The sales tax in Minnesota is 6.875%, which levied on the state level. Moreover, additional sales tax is also levied by counties and cities where rates range between 0% and 2%.

Answer: Most clothing, prescription drugs, and raw groceries are exempted from the Minnesota Sales Tax.

Answer: Most purchases or acquisitions of motor vehicles are subject to 6.5% of sales tax.

Answer: Clothing; all human wearing apparel suitable for general use are exempted from sales tax in Minnesota. However, fur clothing, sports or recreational equipment, clothing accessories or equipment, and protective equipment are subjected to sales tax.

Answer: Yes, internet purchases and purchases through mail order or telephone made from sellers who don't have a physical presence in that state and do not meet the small seller exemption are subject to sales tax in Minnesota.