Sales Tax and Reverse Sales Tax Calculator Maine

(Tax Year 2026: Last Updated on January 30, 2026)

Maine's state general sales tax rate is 5.5 percent. There is no city sales tax in towns or cities in Maine. The Maine sales tax and the reverse sales tax may both be calculated using this calculator. The only information you need to provide to get answers right now is the amount before tax, the amount after tax, and the tax rate.

- 5.5%

- Amount Before Tax ${{amountBeforeTax}}

- Sales Tax Rate {{SalesTaxRate}}%

- Amount Of Taxes ${{AmountOfTaxes}}

- Amount After Taxes ${{AmountAfterTaxes}}

Maine – ST Sales Tax Calculator: User Guide

Mulling over to start, relocate, or expand your business in Maine and looking for a guide to know about sales tax in Maine? Well, you are in the right place.

Our experts have worked days and nights to bring you a comprehensive Maine Sales Tax Guide supported with a handy Maine Sales Tax Calculator to help you start your business venture.

So let's get started with a brief introduction!

Maine, also known as New England State, is located in the northeastern most region of the United States. It is famous for safe towns and cities, welcoming communities, excellent schools, a flourishing economy, a favorable business environment, and tons of recreational opportunities like the ocean, mountains, and other iconic natural sceneries and locales.

Maine Sales Tax Facts:

- The general sales tax rate imposed on the state level in Maine is 5.5%. Fortunately, no city or county in the state levy any additional sales tax. Moreover, no special sales tax rates are applied, so no matter what the buyer's location is in Maine, on 5.5% sales tax would be charged.

- Certain rentals of living quarters are charged with 9% of sales tax.

- Short-term rentals of automobiles, including pickup vans and trucks, are charged with 10% of sales tax.

- Lodging (such as hotels), prepared food, and restaurant meals are charged with 7% of sales tax in Maine.

- Food and prescription drugs are exempt from sales tax in Maine.

- Individuals and companies can use a Maine Sales Tax Exemption Form to buy goods for resale, improvement, or as raw materials without paying Maine Sales Tax.

- Online and out-of-state purchases that are not charged with Maine Sales Tax, but are used in Maine are supposed to be subjected to Maine Use Tax, which is also charged at the same rate as Maine Sales Tax of 5.5%.

- Liquor Tax levied in Maine is 8%.

How to calculate Sales Tax in Maine?

Businesses and Sellers engaged in the retail sale of tangible personal property (TPP), certain lease arrangements or specific services, and having Nexus are required to pay Sales tax to Maine on the sale of specific goods and services.

They are required to collect, manage, and transfers it to the Maine Department of Revenue (LDR) while staying in compliance with state laws and avoid penalties and interest.

Moreover, services which are not subjected to sales tax may be subjected to the service provider tax (imposed on the seller).

The sales tax determined on four factors:

- Nexus: It is a connection of business with a state. The business is only liable to pay taxes to the states with Nexus.

- Out of State Seller's Eligibility: Out of State Seller is only required to register, collect, and remit the sales tax to the state's authorities if it falls under the criteria provided by the state.

- Location and Products or Services: The sales tax rate varies from product to product and location to location. You must check the sales tax rate applicable to your product according to the product category, county, and city in Maine.

- Exemptions: Almost all goods are eligible for sales tax regulation. However, groceries, prescription drugs, and maybe a few more are exempted under Maine Law. So you should check with Maine state government as to which goods and services sold in Maine are subject to sales tax.

To calculate Sales Tax in Maine, follow the steps below:

Step 1 – Determine your Nexus:

As a business owner, you are only required to collect sales tax if you are eligible for collecting sales tax and have Sales Tax Nexus in the Maine State. And to determine your Nexus in Maine, you must have any of the following:

- Selling of tangible personal property (TPP) in the state.

- Maintaining a business location like office, warehouse, and repair facility in Maine.

- Having employees or representatives who request and accept orders in the state.

Step 2 – Determine the eligibility to collect sales tax as a seller:

Out of State Seller is eligible to register, collect and remit sales tax under Maine Law, if:

- The out of state seller has a gross revenue exceeding $100,000 into Maine in the previous or current calendar year.

- OR, Makes 200 or more sales in the previous or current calendar year in Maine.

Step 3 – Determine the Sales Tax Rate:

Once you have determined that your Nexus is with Maine, next is to deduce the Sales Tax rate (State County + City Sales Tax) applicable to your product. However, as no city or county in Maine levy local sales tax, so sales tax rate remains the same throughout Maine.

Step 4 – Calculate Sales Tax:

After determining the sales tax rate according to the location and type of purchases, it is easy to calculate the sales tax amount charged on the product and gross price (amount after tax) of a product.

Example # 1:

For instance, you are selling a Dinnerware Set on your store in Portland, Maine, having a net price tag of $150. The amount that a buyer has to pay (including sales tax) on a check out would be:

Manual Method:

Net Price (amount before Tax) of a Dinnerware Set: $150

Total Sales Tax rate: 0.00% (Portland) + 0.00% (Cumberland) + 5.50% (Maine State) = 5.50%

Total Sales Tax amount = $150 x 5.50% = $8.25

Gross Price (Amount after Tax) = 150 + 8.25 = $158.3

It means the amount the buyer has to pay for a Dinnerware Set on a cash counter would be $158.3.

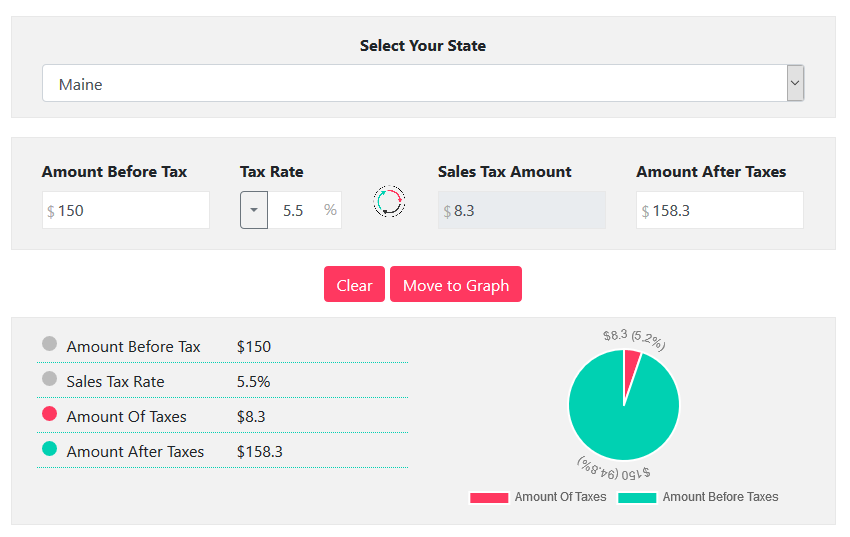

Using our Sales Tax Calculator:

All of the steps mentioned above can be skipped to get an instant result using our Sales Tax Calculator. All you need is:

- Input the $140 Net Price of a Dinnerware Set as Amount Before Tax

- Input or select 50% of the combined Sales Tax rate on the Tax Rate menu.

Our calculator will automatically calculate the result, and represents it in 3 different forms, as shown in the image below:

Reverse Sales Tax Calculation

In the example above, we have explained to you to calculate the Sales Tax amount payable in a product, and the Gross Price of the Product.

But there are also instances when you are required to deduce how much sales tax buyer has actually paid on a product or you may want to check the accuracy of the sales tax indicated on your item's receipt.

This is where the Reverse Sales Tax Calculation Kicks in. And luckily, our Maine Sales Tax Calculator can perform this calculation like a Pro.

Example:

Your buyer has paid $95 for a Bread Toaster at your store in Lewiston, Maine. Now the buyer is inquiring how much a Bread Toaster actually cost before the sales tax was added. So you need to follow the steps below to determine the amount before tax (net price) of a Bread Toaster:

Gross Price (Amount after Tax) of Bread Toaster: $95

Total Sales Tax rate: 0.00% (Lewiston) + 0.00% (Androscoggin) + 5.50% (Maine State) = 5.50%

Manual Method:

Gross Price with sales tax = [Net Price × (tax rate in decimal form + 1)]

95 = [Net Price x ((5.50/100) + 1)]

95 = Net Price x 1.06

$89.6 = Net Price

So the original Price (net price) of the Bread Toaster was $89.6.

Using our Sales Tax Calculator:

You can also use our Sales Tax Calculator for Reverse Sales Tax calculation to skip the above mentioned manual method. All you need is:

- Input the $95 Gross Price of Bread Toaster as Amount after Tax

- Input or select 5.50% of the combined Sales Tax Rate on the Tax Rate

Our calculator will automatically calculate the result and represents it in 3 different forms.

FAQs

Answer: The general sales tax rate imposed on the state level in Maine is 5.5%. Fortunately, no city or county in the state levy any additional sales tax.

Answer: 5.5% of sales tax is charged on the purchase of vehicles in Maine.

Answer: Generally, Maine doesn't charge sales tax on services, but some services are subjected to sales tax, while others are subjected to the service provider tax, which is imposed on the seller.

Answer: Yes, prepared food and restaurant meals are charged with 7% of sales tax in Maine.

Answer: No, groceries are exempted from the Maine sales tax.