Sales Tax and Reverse Sales Tax Calculator South Dakota

(Tax Year 2026: Last Updated on January 30, 2026)

South Dakota's general sales tax rate is 4.5%. South Dakota's counties, cities, and/or municipalities are free to collect their own rate of up to 3% in local sales tax. This calculator computes the standard and reverses sales taxes in South Dakota. The only information required to generate the fast results is the amount before and after taxes, as well as the tax rate.

- 4%

- 4.5%

- 5.5%

- 6.5%

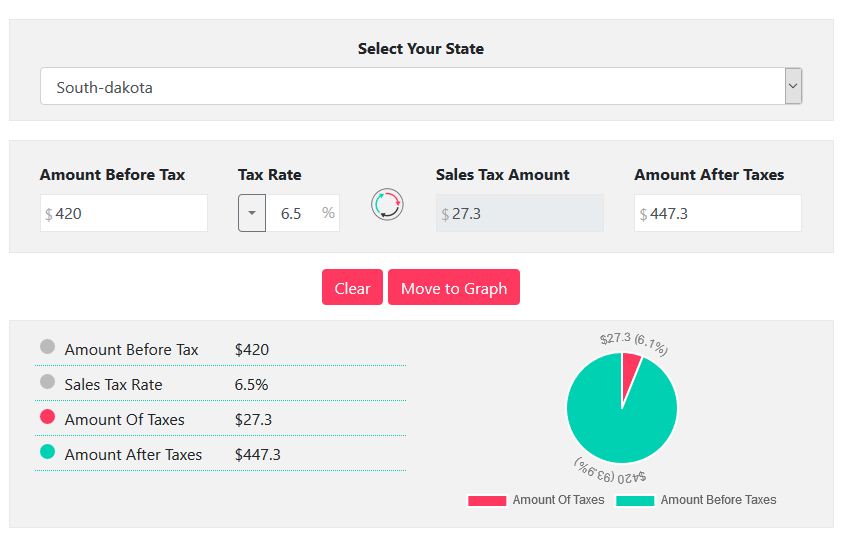

- Amount Before Tax ${{amountBeforeTax}}

- Sales Tax Rate {{SalesTaxRate}}%

- Amount Of Taxes ${{AmountOfTaxes}}

- Amount After Taxes ${{AmountAfterTaxes}}

South Dakota – SD Sales Tax Calculator: User Guide

South Dakota is the 5th least densely populated, seventeenth largest by area, and fifth smallest by population State of United States of America. It is situated in the Midwestern region of the United States.

Also known as the Mount Rushmore State, the South Dakota State shares its border with

Pierre is the capital of South Dakota, while Sioux Falls, the largest city and Sioux Falls metropolitan area is the largest metropolitan of the state.

From the Black Hills to Mount Rushmore, the state plenty of unspoiled landscapes and natural wonders. Besides, it also offers low-cost living expenses, not-too-crowded cities, inspiring and adventurous lifestyle, spacious surroundings, No income tax, a flourishing economy, numerous Job opportunities, and Booming business.

All these aforementioned perks have forced countless people to settle in this amazing state to start their new life, career, or business. If you are one of them, planning to start, relocate, or expand your business in South Dakota, you should learn to deal with South Dakota Sales Tax.

South Dakota Sales Tax Facts:

- 5% of sales tax is charged on the state level in South Dakota on the gross receipts of all the retail sale, lease, or rental of tangible personal property, the sales of most services, and any product transferred electronically.

- On top of statewide sales tax, many cities in the state levy local sales tax, ranging from 0 to 3%. In some cases, a special sales tax rate may also apply, ranging from 0% to 4.5%.

- All goods, products, and services that are used, stored, or consumed in South Dakota without being subjected to SD Sales tax are supposed to be subjected to South Dakota Use tax of the same rate as the sales tax.

- 9% of states in the US have a lower sales tax rate than South Dakota.

- Roslyn, South Dakota, is among cities that levy the highest possible combined sales tax rate of 7.5%.

- Saint Francis, South Dakota, is among the cities that levy the lowest possible combined sales tax rate of 4.5%.

- The purchase is intended for resale, exempt use, or an exempt entity can be bought without paying SD sales tax using South Dakota Sales Tax Exemption Certificate.

- Banking services performed by registered institutions, as well as travel agencies, agricultural services, medical services, social services, and educational services, are among services that are exempted from sales tax in South Dakota.

- Water purchased in bulk or through a water supply system, prescription drugs, purchases made with food stamps, and lottery tickets is among tangible personal properties exempted from SD Sales Tax. However, unlike most other states, all other types of food purchases are taxed.

- The municipalities may also impose a 1% municipal gross receipts tax (MGRT) on items including lodging accommodations, athletic, alcoholic beverages, eating establishments, admissions to places of amusement, and cultural events.

- Certain lodging and amusement services may also be subjected to a tourism tax of 1.5%.

How to calculate Sales Tax in South Dakota?

Businesses and Sellers involved in the gross sales or transactions, including retail sale, lease, or rental of taxable tangible personal property, some services or any product transferred electronically, as well as have Nexus in South Dakota are required to register for Sales tax.

They must collect, manage, and remit it to the South Dakota Department of Revenue while staying in compliance with state laws and avoid penalties and interest.

The sales tax determined on four factors:

- Nexus: It is a connection of business with a state. The business is only liable to pay taxes to the states with Nexus.

- Out of State Seller's Eligibility: Out of State Seller is only required to register, collect, and remit the sales tax to the authorities in the state if it falls under the criteria provided by the state.

- Location and Products or Services: The sales tax rate varies from product to product and location to location, so you must check the sales tax rate applicable to your product according to the product category, county, and city in South Dakota.

- Exemptions: Almost all goods are eligible for sales tax regulation. However, tangible personal properties including Water purchased in bulk or through a water supply system, prescription drugs, purchases made with food stamps and lottery tickets, and certain services like Banking services performed by registered institutions, as well as travel agencies, agricultural services, medical services, social services, and educational services are among items and services which are exempted under South Dakota Law.

So you should check with the South Dakota state government as to which goods and services sold in South Dakota are subject to sales tax.

To calculate Sales Tax in South Dakota, follow the steps below:

Step 1 – Determine your Nexus:

As a business owner, you are only required to collect sales tax if you are eligible for collecting sales tax and have Sales Tax Nexus in the South Dakota State. And to determine your Nexus in South Dakota, you must have any of the following:

- Maintaining a physical location in South Dakota, such as office, warehouse, retail store, or other business locations.

- An employee or independent sales representative working for you in South Dakota.

- Having inventory in South Dakota

Step 2 – Determine the eligibility to collect sales tax as an out-of-state seller:

Out of State Seller is eligible to register, collect and remit sales tax under South Dakota Law, if:

- They have gross revenue of over $100,000 from sales of taxable goods or services delivered into South Dakota;

- Minimum 200 separate transactions into South Dakota.

Step 3 – Determine the Sales Tax Rate:

Once you have determined that your Nexus is with South Dakota, next is to deduce the Sales Tax rate (State+City) applicable to your product, for which you can refer to the table below:

| City | State Rate | City Rate | Total Sales Tax |

|---|---|---|---|

| Aberdeen | 4.50% | 2.00% | 6.50% |

| Alcester | 4.50% | 2.00% | 6.50% |

| Alexandria | 4.50% | 2.00% | 6.50% |

| Arlington | 4.50% | 2.00% | 6.50% |

| Armour | 4.50% | 2.00% | 6.50% |

| Aurora | 4.50% | 1.00% | 5.50% |

| Avon | 4.50% | 2.00% | 6.50% |

| Baltic | 4.50% | 2.00% | 6.50% |

| Belle Fourche | 4.50% | 2.00% | 6.50% |

| Beresford | 4.50% | 2.00% | 6.50% |

| Box Elder | 4.50% | 2.00% | 6.50% |

| Brandon | 4.50% | 2.00% | 6.50% |

| Britton | 4.50% | 2.00% | 6.50% |

| Brookings | 4.50% | 2.00% | 6.50% |

| Burke | 4.50% | 2.00% | 6.50% |

| Canton | 4.50% | 2.00% | 6.50% |

| Castlewood | 4.50% | 2.00% | 6.50% |

| Centerville | 4.50% | 2.00% | 6.50% |

| Chamberlain | 4.50% | 2.00% | 6.50% |

| Clark | 4.50% | 2.00% | 6.50% |

| Clear Lake | 4.50% | 2.00% | 6.50% |

| Colman | 4.50% | 2.00% | 6.50% |

| Colton | 4.50% | 2.00% | 6.50% |

| Crooks | 4.50% | 2.00% | 6.50% |

| Custer | 4.50% | 2.00% | 6.50% |

| De Smet | 4.50% | 2.00% | 6.50% |

| Deadwood | 4.50% | 2.00% | 6.50% |

| Dell Rapids | 4.50% | 2.00% | 6.50% |

| Eagle Butte | 4.50% | 2.00% | 6.50% |

| Edgemont | 4.50% | 2.00% | 6.50% |

| Elk Point | 4.50% | 2.00% | 6.50% |

| Elkton | 4.50% | 2.00% | 6.50% |

| Estelline | 4.50% | 2.00% | 6.50% |

| Eureka | 4.50% | 2.00% | 6.50% |

| Faulkton | 4.50% | 2.00% | 6.50% |

| Flandreau | 4.50% | 2.00% | 6.50% |

| Fort Pierre | 4.50% | 2.00% | 6.50% |

| Freeman | 4.50% | 2.00% | 6.50% |

| Garretson | 4.50% | 2.00% | 6.50% |

| Gettysburg | 4.50% | 2.00% | 6.50% |

| Gregory | 4.50% | 2.00% | 6.50% |

| Groton | 4.50% | 2.00% | 6.50% |

| Harrisburg | 4.50% | 2.00% | 6.50% |

| Hartford | 4.50% | 2.00% | 6.50% |

| Highmore | 4.50% | 2.00% | 6.50% |

| Hill City | 4.50% | 2.00% | 6.50% |

| Hot Springs | 4.50% | 2.00% | 6.50% |

| Howard | 4.50% | 2.00% | 6.50% |

| Huron | 4.50% | 2.00% | 6.50% |

| Ipswich | 4.50% | 2.00% | 6.50% |

| Kadoka | 4.50% | 2.00% | 6.50% |

| Lake Andes | 4.50% | 2.00% | 6.50% |

| Lake Norden | 4.50% | 2.00% | 6.50% |

| Lead | 4.50% | 2.00% | 6.50% |

| Lemmon | 4.50% | 2.00% | 6.50% |

| Lennox | 4.50% | 2.00% | 6.50% |

| Madison | 4.50% | 2.00% | 6.50% |

| Marion | 4.50% | 2.00% | 6.50% |

| Martin | 4.50% | 2.00% | 6.50% |

| Milbank | 4.50% | 2.00% | 6.50% |

| Miller | 4.50% | 2.00% | 6.50% |

| Mission | 4.50% | 2.00% | 6.50% |

| Mitchell | 4.50% | 2.00% | 6.50% |

| Mobridge | 4.50% | 2.00% | 6.50% |

| Newell | 4.50% | 2.00% | 6.50% |

| North Sioux City | 4.50% | 2.00% | 6.50% |

| Onida | 4.50% | 2.00% | 6.50% |

| Parker | 4.50% | 2.00% | 6.50% |

| Parkston | 4.50% | 2.00% | 6.50% |

| Philip | 4.50% | 2.00% | 6.50% |

| Piedmont | 4.50% | 2.00% | 6.50% |

| Pierre | 4.50% | 2.00% | 6.50% |

| Plankinton | 4.50% | 2.00% | 6.50% |

| Platte | 4.50% | 2.00% | 6.50% |

| Rapid City | 4.50% | 2.00% | 6.50% |

| Redfield | 4.50% | 2.00% | 6.50% |

| Roslyn | 4.50% | 3.00% | 7.50% |

| Saint Francis | 4.50% | 0.00% | 4.50% |

| Salem | 4.50% | 2.00% | 6.50% |

| Scotland | 4.50% | 2.00% | 6.50% |

| Selby | 4.50% | 2.00% | 6.50% |

| Sioux Falls | 4.50% | 2.00% | 6.50% |

| Sisseton | 4.50% | 2.00% | 6.50% |

| Spearfish | 4.50% | 2.00% | 6.50% |

| Springfield | 4.50% | 2.00% | 6.50% |

| Sturgis | 4.50% | 2.00% | 6.50% |

| Summerset | 4.50% | 2.00% | 6.50% |

| Tea | 4.50% | 2.00% | 6.50% |

| Tyndall | 4.50% | 2.00% | 6.50% |

| Vermillion | 4.50% | 2.00% | 6.50% |

| Viborg | 4.50% | 2.00% | 6.50% |

| Volga | 4.50% | 2.00% | 6.50% |

| Wagner | 4.50% | 2.00% | 6.50% |

| Wall | 4.50% | 2.00% | 6.50% |

| Watertown | 4.50% | 2.00% | 6.50% |

| Webster | 4.50% | 2.00% | 6.50% |

| Wessington Springs | 4.50% | 2.00% | 6.50% |

| Whitewood | 4.50% | 2.00% | 6.50% |

| Winner | 4.50% | 2.00% | 6.50% |

| Worthing | 4.50% | 2.00% | 6.50% |

| Yankton | 4.50% | 2.00% | 6.50% |

Step 4 – Calculate Sales Tax:

As the Sales Tax rate in South Dakota is the same, so it is easy to calculate the sales tax amount charged on the product and gross price (amount after tax) of a product.

Example # 1:

For instance, you sell a Microwave Oven on your store in Vermillion, South Dakota, having a net cost of $420. The amount of Sales Tax that you have to pay on the Microwave Oven would be:

Manual Method:

Net Price (amount before Tax) of a Microwave Oven: $420

Total Sales Tax rate: 2.00% (Greenwood) + 0.00% (Clay County) + 4.50% (South Dakota State) = 6.50%

Total Sales Tax amount = $420 x 6.50% = $27.3

Gross Price (Amount after Tax) = 420 + 27.3 = $447.3

The sales tax amount charged on the Microwave Oven would be $27.3, raising the gross cost of it to $447.3.

Using our Sales Tax Calculator:

All of the steps mentioned above can be skipped to get an instant result using our Sales Tax Calculator. All you need is:

- Input the $420 Net Price of a Microwave Oven as Amount Before Tax

- Input or select 50% of the combined Sales Tax rate on the Tax Rate menu.

Our calculator will automatically calculate the result and represents it in 3 different forms, as shown in the image below:

Reverse Sales Tax Calculation

In the example above, we have explained to you to calculate the Sales Tax amount payable in a product and the Gross Price of the Product.

But there are also instances when you are required to deduce how much Sales tax you have actually paid on a product in South Dakota.

This is where the Reverse Sales Tax Calculation Kicks in. And luckily, our South Dakota Sales Tax Calculator can perform this calculation like a Pro.

Example:

The gross cost (amount after tax) of a Coffee Maker is $320, which you sell on your store in Roslyn, South Dakota. Now, if you want to deduce the amount of sales tax you have actually paid on it and the net cost (amount before tax) of a Coffee Maker, you can follow the steps below:

Gross Price (Amount after Tax) of Coffee Maker: $320

Total Sales Tax rate: 3.00% (Roslyn) + 0.00% (Day County) + 4.50% (South Dakota State) = 7.50%

Manual Method:

Gross Price with sales tax = [Net Price × (tax rate in decimal form + 1)]

320 = [Net Price x ((7.5/100) + 1)]

320 = Net Price x 1.08

$296 = Net Price

So the original Price (net price) of the Coffee Maker would be $296.

Using our Sales Tax Calculator:

You can also use our Sales Tax Calculator for Reverse Sales Tax calculation to skip the aforementioned manual method. All you need is:

- Input the $320 Gross Price of Coffee Maker as Amount after Tax

- Input or select 7.50% of combined Sales Tax Rate on the Tax Rate

Our calculator will automatically calculate the result and represents it in 3 different forms.

FAQs

Answer: 4.5% of sales tax is charged on the state level in South Dakota. On the top, many cities in the state levy local sales tax, which ranges from 0 to 3%.

Answer: 6.5% of the combined sales tax rate is charged in Sioux Falls, South Dakota, which comprises 2.00% of Sioux Falls city sales tax and 4.5% of South Dakota State sales tax.

Answer: es, all food sales are taxed in South Dakota at 4.5% of state sales tax plus city sales tax.