Sales Tax and Reverse Sales Tax Calculator Pennsylvania

(Tax Year 2026: Last Updated on January 30, 2026)

Pennsylvania's general sales tax rate is 6%. Pennsylvania has an additional city sales tax of up to 2%. This calculator can compute Pennsylvania's standard and reverse sales taxes. The only information needed to compute the results swiftly is the amounts before and after taxes, as well as the tax rate.

- 6%

- 7%

- 8%

- Amount Before Tax ${{amountBeforeTax}}

- Sales Tax Rate {{SalesTaxRate}}%

- Amount Of Taxes ${{AmountOfTaxes}}

- Amount After Taxes ${{AmountAfterTaxes}}

Pennsylvania - PA Sales Tax Calculator: User Guide

Pennsylvania is a constituent state of the United States of America, officially known as the Commonwealth of Pennsylvania. This state is located in Great Lakes, Appalachian, Northeastern, and Mid-Atlantic regions of the country. While it shares its borders with New Jersey to the east, Ohio to the west, New York to the north, Maryland to the south, Delaware to the southeast, West Virginia to the southwest, and Lake Erie to the northwest.

This Commonwealth-State the 5th-most populous and the 33rd-largest state by area. It is loaded with rich American history, superb educational opportunities, stunning landscapes, chocolate galore, and affordable living options. This state also has a 6th largest GDP in America and is an industrial and agricultural powerhouse, making it a heaven for thriving startup and creative entrepreneurs.

Mulling over to relocate, expand, or start your business in the Commonwealth of Pennsylvania? Well, you should learn to deal with PA sales tax.

Our experts have worked days and nights to bring you a comprehensive guide along with a handy Pennsylvania Sales Tax calculator, to educate you with all the essentials of PA Sales Tax.

So let's dig in!

Pennsylvania Sales Tax Facts:

- 6% is the statewide base sales tax in Pennsylvania. This rate remains the same throughout the state, with two exceptions. First is in Philadelphia, where 2% of local sales tax is charged additionally, and another one is in Allegheny County (which includes the city of Pittsburgh), where an additional 1% of local sales tax is levied. So, the maximum possible combined sales tax charged in the PA state is 8%.

- Northwood, Pennsylvania, is among the cities which levies the highest possible combined sales tax of 8%.

- Aaronsburg is among the cities which levies the lowest possible combined sales tax of 6%.

- 139% is the average combined sales tax rate charged in Pennsylvania.

- Most groceries, candy and gum, computer services, clothing and footwear, toilet paper, most medicine, textbooks, sales for resale, farm supplies, internet service, fitness club fees, and residential fuels including natural gas, firewood, and electricity are exempted from Pennsylvania sales tax.

- Taxable purchases of tangible personal property or specified services used or consumed in Pennsylvania, which are not subjected to sales tax is by the vendor, should be subjected to PA Use Tax(at the same rate as sales tax).

- Room rental charges for periods of less than 30 days by the same person are subjected to the hotel occupancy tax, which is levied at the same rate as sales tax.

- Rooms, apartments, and houses rented through online or third-party brokers are also subjected to the hotel occupancy tax.

- The individual and businesses can use the Pennsylvania Sales Tax Exemption Form for purchasing goods for resale, improvement, or as raw materials without sales tax.

How to calculate Sales Tax in Pennsylvania?

Businesses and Sellers who have Nexus are required to pay Sales tax to Pennsylvania on retail sales, consumption, rental of particular tangible personal property, digital products, and specific services (relating to property and on the charge for specific business services). They must collect, manage, and transfer it to the Pennsylvania Department of Revenue while staying in compliance with state laws and avoid penalties and interest.

The sales tax determined on four factors:

- Nexus: It is a connection of business with a state. The business is only liable to pay taxes to the states with Nexus.

- Location and Products or Services: The sales tax rate varies from product to product and location to location. You must check the sales tax rate applicable to your product according to the product category, county, and city in Pennsylvania.

- Exemptions: Almost all tangible goods and certain services are eligible for sales tax regulation. However, Most groceries, candy and gum, computer services, clothing and footwear, toilet paper, most medicine, textbooks, sales for resale, farm supplies, internet service, fitness club fees, and residential fuels including natural gas, firewood, and electricity are exempted from NY Sales Tax. You should check with the Pennsylvania state government to update which goods and services sold in Pennsylvania are subject to sales tax.

To calculate Sales Tax in Pennsylvania, follow the steps below:

Step 1 – Determine your Nexus:

As a business owner, you are only required to collect sales tax if you are eligible for collecting sales tax and have Sales Tax Nexus in Pennsylvania State. And to determine your Nexus in Pennsylvania, you must have any of the following:

- Having a physical place of business places like an office, store, or warehouse in the state.

- Having a leasing property in the state.

- An employee, independent contractors, or other representatives present in Pennsylvania.

- Ownership personal or real property in the state.

- Having inventory or goods stored in a warehouse in Pennsylvania.

- Merchandise delivered in Pennsylvania on a vehicle owned by the taxpayer.

Step 2 – Determine the Sales Tax Rate:

Once you have determined that your Nexus is with Pennsylvania, next is to deduce the Sales Tax rate (State + Local Sales Tax) applicable on your product, for which you can refer the tables below:

Pennsylvania Sales Tax Rates by Location:

Once you have determined that your Nexus is with Pennsylvania, next is to deduce the Sales Tax rate (State + County) applicable to your product, for which you can refer the points below:

- 6% is the statewide base sales tax in Pennsylvania. This rate remains the same throughout the state, with two exceptions. First is in Philadelphia, where 2% of local sales tax is charged additionally. The other one is in Allegheny County (which includes the city of Pittsburgh), where an additional 1% of local sales tax is levied.

Step 4 – Calculate Sales Tax:

After determining the sales tax rate according to the location and type of purchases, it is easy to calculate the sales tax amount charged on the product and gross price (amount after tax) of a product.

Example # 1:

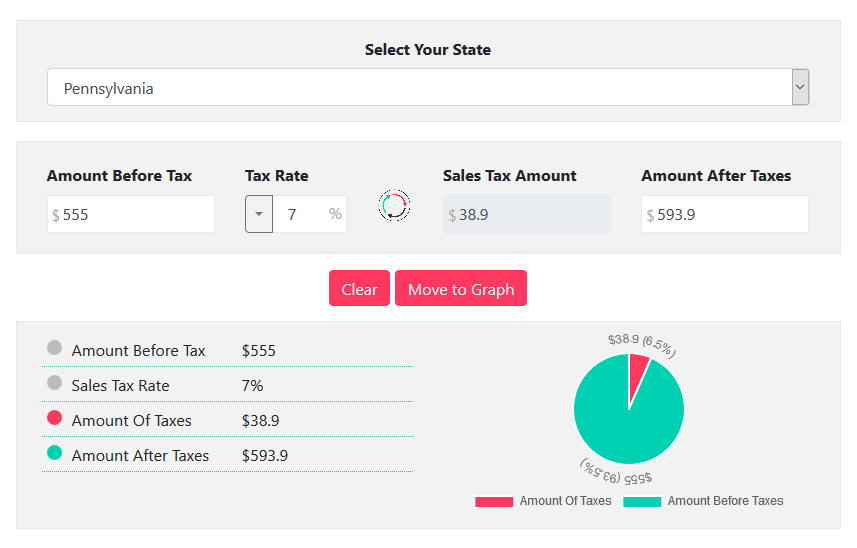

For instance, you are selling a LED TV on your store in Bethel Park, Pennsylvania, having a net price tag of $555. The amount that a buyer has to pay (including sales tax) on a check out would be:

Manual Method:

Net Price (amount before Tax) of a LED TV: $555

Total Sales Tax rate: 0.00% (Afton) + 1.00% (Allegheny County) + 6.00% (Pennsylvania State) = 7.00%

Total Sales Tax amount = $555 x 7.00% = $38.9

Gross Price (Amount after Tax) = 555 + 38.9 = $593.9

It means the buyer has to pay $593.9 for a LED TV on a cash counter.

Using our Sales Tax Calculator:

All of the steps mentioned above can be skipped to get an instant result using our Sales Tax Calculator. All you need is:

- Input the $555 Net Price of the LED TV as Amount Before Tax

- Input or select 00% of the combined Sales Tax rate on the Tax Rate menu.

Our calculator will automatically calculate the result, and represents it in 3 different forms, as shown in the image below:

Reverse Sales Tax Calculation

In the example above, we have explained to you to calculate the Sales Tax amount payable in a product, and the Gross Price of the Product.

But there are also instances when you are required to deduce how much sales tax buyer has actually paid on a product or you may want to check the accuracy of the sales tax indicated on your item's receipt.

This is where the Reverse Sales Tax Calculation Kicks in. And luckily, our Pennsylvania Sales Tax Calculator can perform this calculation like a Pro.

Example:

Your buyer has paid $850 for a Home Theatre at your store in Adams Basin, Pennsylvania. Now the buyer is inquiring how much a Home Theatre actually cost before the sales tax was added. So you need to follow the steps below to determine the amount before tax (net price) of a Home Theatre:

Gross Price (Amount after Tax) of Home Theatre: $850

Total Sales Tax rate: 0.00% (Philadelphia) + 2.00% (Philadelphia County) + 6.00% (Pennsylvania State) = 8.00%.

Manual Method:

Gross Price with sales tax = [Net Price × (tax rate in decimal form + 1)]

850 = [Net Price x ((8.00/100) + 1)]

850 = Net Price x 1.08

$787 = Net Price

So the original Price (net price) of a Home Theatre was $787.

Using our Sales Tax Calculator:

You can also use our Sales Tax Calculator for Reverse Sales Tax calculation to skip the aforementioned manual method. All you need is:

- Input the $850 Gross Price of Home Theatre as Amount after Tax

- Input or select 8.00% of combined Sales Tax Rate on the Tax Rate

Our calculator will automatically calculate the result and represents it in 3 different forms.

FAQs

Answer: The retail sale, consumption, rental of particular tangible personal property, digital products, and specific services (relating to property and on the charge for specific business services) are subject to sales tax in Pennsylvania.

Answer: Most clothing items are exempted from the Pennsylvania Sales Tax.

Answer: Most medicine, most groceries, candy and gum, internet service, textbooks, computer services, clothing and footwear, toilet paper, sales for resale, farm supplies, internet service, fitness club fees, and residential fuels including natural gas, firewood, and electricity are sales tax free in Pennsylvania.

Answer: No, most groceries, candy, and gum except Alcohol are exempted from sales tax in Pennsylvania – PA.